This is the correct graph. (Source.) Thanks, Roger!

Graph 1 Gasoline Supplied

The fall off in gasoline delivery is not as extreme as I indicated, but it is still real. Here is a close-up view of data for the current century, from the same source.

Graph 2 Gasoline Supplied This Century

Seasonal changes are dramatic. Peaks occur in July or August, valleys in January or February of most years. May values, highlighted with blue dots, and September values, highlighted with yellow dots, are recurring secondary peaks and valleys, respectively. July values are highlighted with red dots. The years 2008 and 2010 are accented with contrasting blue line segments.

In 2008, gasoline consumption dropped dramatically. May was down slightly, compared to '07, while July and September were down a lot. Through 2009 and '10 there was a slight recovery, with all three highlighted months showing increases. The 12 month moving average, in pink, stopped falling, but failed to increase very much.

Then, in 2011, gasoline deliveries turned down again. This can be seen clearly in the highlighted months and the moving average. Some of the standard explanations are changing demographics and retail habits. An aging population with more retirees might tend to drive less - though this is not my personal experience. Kids these days cruise on social media rather than pleasure drive through the streets of town as we did in my day. On-line shopping, though only about 5% of total retail, is growing rapidly.

You can't gainsay any of these trends. They are probably affecting the big picture. But it would a stretch to say that they can account for less gasoline use in 2011, but not 2010 or 2009. Especially so, since this past year was supposed to be a recovery from the previous economic doldrums, and the expectation would be for the improvements of the previous two years to continue. But it looks like something is happening, economically or culturally, to cause another downturn in travel - though not as dramatically as I suggested in the original post.

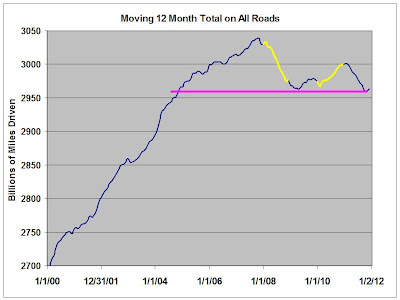

The estimate of vehicle miles driven, from the December, 2011 report by the Federal Highway Administration, tells a similar story.

Graph 3 Vehicle Miles Driven - Moving Total

The years 2008 and 2010 are highlighted in yellow. The pink line traces the November, 2011 low back through the Summer of 2004. Again we see recovery in 200o and '10, and a resumption of the slide in 2011.

The slope change in mid-2005 is intriguing. This precedes the April 2006 peaks in the Case-Shiller Composite-10 and Composite-20 Indexes by several months, and the October 2007 peak in the S&P 500 by over 2 years. The new slope remains relatively constant right up to the peak in November, 2007.

Meanwhile, gasoline prices have increased again in the last month, after sliding about 70 cents from the high in May, 2011. This gloomy article at Seeking Alpha blames part of the price increase on "stronger demand, courtesy of a growing economy." The data simply does not support this opinion. Instead of text book supply-demand behavior, gasoline prices and miles driven exhibit basically similar motion.

I still contend that the prices of petroleum products are manipulated on the supply side. All the data I'm aware of supports this.

I expected the original post to be a one-off, but the current picture is interesting, with no obvious explanation. This might bear looking into in another 6 months, or so.

Cross posted at Angry Bear.

2 comments:

lebron james shoes

russell westbrook shoes

yeezys

nike shox

curry 7

curry 7 shoes

hermes belt

yeezy boost 350 v2

steph curry shoes

cheap jordans

high replica bags h98 v0y62s7d15 best replica bags b44 l7r49y5l49 gucci replica m87 h7v47p5w39

Post a Comment