Monday, July 19, 2021Bright Red Flashing Arrow DownDJI30 Index at the Close ---

33,962.04-725.81 (-2.09%)SP500 Index ---

4,258.49-68.67 (-1.59%)The DJI opened at 34528, off 159 points, and the hi for the day. Then the bottom dropped out. It immediately fell to 34170, off 518. It hovered there for 15 minutes, then slid to about 33850, off 838. It rattled around that level for an hour and a half, rose to 34000 before noon, then slid further to 33742, the day's lo. It bounced around there from 1:30 until after 2:30, when it rose into the close on a volume surge.

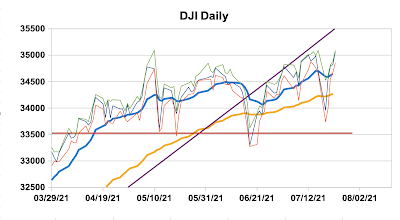

This is a clearly down day, with the hi and lo lower by 561 and 906 points, respectively. The span was 787. The loss is dramatic and painful, but the Index is above its presumptive support zone, and the 13 day EMA is above the 55 day EMA. It was today's big loser. The index has traded in a range since early May and is approaching the bottom of that range. Follow-through during the rest of the week will be important.

The SP500 had a clearly down day with a similar contour. It closed deeply within its presumptive support zone from early May, and below its trend channel from the March, 2020 lo. It has just about doubled over that time.

The NASDAQ was also clearly down. At the low, it was right at the presumptive support level from the former highs in February, April and June. It is marginally above the trend channel and the 55 day EMA.

The Russell 2000 was also clearly down. It landed deeply within the prospective support region from January. It is now below the trend channel from March 2020. This is the only index where the 13 day EMA is below the 55 day EMA. This happened on Friday, the the gap widened today.

If there's a bright spot, its that there was partial recovery at the close for all the indexes, on volume surges. The word on the street is that this was caused by a sudden surge in covid fears. As you can imagine, I'm skeptical. Was there big news on that from today? This might be the start of the correction many analysts have been predicting. It could be a bumpy ride for the next weeks to months, so fasten your safety belts. NYSE internals are terrible, and on above average volume.

Daily changes -

DJI30 -2.09%

SP500 -1.59%

NASDAQ -1.06%

Russell -1.51%

DJI Closings -

7/19/19 - 27154

7/17/20 – 26735

6/18/21 - 33823

7/19/21 - 33783

NYSE Internals -

A/D = 516/2879 = 0.18

A/D Vol = 0.11

New Hi/Lo = 20/96 = 0.21

Tuesday, July 20, 2021

Green Arrow Up

DJI30 Index at the close --- 34,511.99 +549.95 (+1.62%)

SP500 Index --- 4,323.06 +64.57 (+1.52%)

The DJI opened at 33982, up 20 points. In less than an hour it was at 34475, up 513, on the way to 43622, up 660, before 1:00. After that it ran mostly sideways, with a slide into the close on a volume surge.

This is a clearly up day, with the hi and lo higher by 93 and 240 points.

The SP500 also had a clearly up day, and moved above its support range, landing close to the bottom of its trend channel.

The NASDAQ also had a clearly up day. It bounced off the top of its support range and has stayed above its trend line.

The Russell 2000 had a clearly up day, and was today's big winner. It rose above its support range, and back within its trend channel.

The NYSE internals are almost a perfect reversal of yesterday's. It's comforting that yesterday's plunge did not continue. Less so that the recovery of the indexes were only partial. The end of day slumps were not large, but the accompanying volume surges on the SP500 and NYSE are troubling.

The question now is does today's rebound indicate a recovery, or is it counter to a broader down-side move? What happens in the next few days should help answer this question.

Daily changes -

DJI30 +1.62%

SP500 +1.52%

NASDAQ +1.57%

Russell +2.98%

DJI Closings -

7/19/19 - 27154

7/20/20 – 26681

6/18/21 - 33290

7/20/21 – 34512

NYSE Internals -

A/D = 2759/577 = 4.78

A/D Vol = 9.38

New Hi/Lo = 96/30 = 3.20

Wednesday, July 21, 2021

Green Arrow Up

DJI30 index at the Close --- 34,798.00 +286.01 (+0.83%)

SP500 Index --- 4,358.69 +35.63 (+0.82%)

The DJI opened at 34557, up 13 points, and reached 34798, up 254, before 10:00. After a slump to 34700 at 11:30, it reached the hi again before noon, then stayed above 34750, except for a brief moment 10 minutes before the close. Followed by the day's hi of 34 820, and a volume surge into the close.

This is a clearly up day, with the hi and lo higher by 198 and 575 points, respectively. The span was 263.

It was clearly up for all the indexes. The SP500 moved almost identically to the DJI. It climbed back above its trend line. The NASDAQ remains above its trend line. The Russell 2000 is now above its support range and back into its trend channel. It is today's big winner.

Evidently the Covid concerns that caused the big drop on Monday are no longer in effect. Never mind that cases are on the rise and the delta variant is dominating the new cases.

Please get vaccinated it you haven't already. Your life is on the line.

Daily changes -

DJI30 +0.83%

SP500 +0.82%

NASDAQ +0.92%

Russell +1.81%

DJI Closings -

7/19/19 - 27154

7/21/20 – 26840

6/21/21 - 33946

7/20/21 – 34798

NYSE Internals -

A/D = 2417/874 = 2.77

A/D Vol = 5.63

New Hi/Lo = 113/18 = 6.28

Thursday, July 22, 2021

Green Arrow Up

DJI30 Index at the close --- 34,823.35 +25.35 (+0.07%)

SP500 Index --- 4,367.48 +8.79 (+0.20%)

The DJI opened at 34799, up 2 points and fell for 7 minutes, reaching a lo of 34673, off 125. It hovered near 34800 from 10:15 to 11:30, slipped back to 34700 after 12:00, then crossed into positive territory after 1:30. It hit a hi of 34879, up 81 after 2:00. It ran sideways for about an hour, then slid into the close for a meager gain.

This is a clearly up day, with the hi and lo up by 59 and 116 points. The span was 206.

The SP500 also had a clearly up day, by small margins.

As did the NASDAQ.

In contrast, the Russell had a clearly down day, with the hi and lo lower by only 3 points each, but the close was down by well over a percent.

This was rather a ho-hum day. Except for the NASDAQ, the indexes have been trading in ranges for months now – though with considerable volatility.

Today, volumes were unusually low, across the board. I have no idea why, or what this means.

Daily changes -

DJI30 +0.07%

SP500 +0.20%

NASDAQ +0.36%

Russell -1.55%

DJI Closings -

7/22/19 - 27172

7/22/20 – 27006

6/22/21 - 33946

7/22/21 – 34823

NYSE Internals -

A/D = 1018/2259 = 0.45

A/D Vol = 0.32

New Hi/Lo = 77/22 = 3.50

Friday, July 23, 2021

Green Arrow Up

DJI30 Index at the close --- 35,061.42 +238.07 (+0.68%)

SP500 Index --- 4,411.79 +44.31 (+1.01%)

The DJI opened at 34855, up 32 points, and quickly soared to 35057, up 234. But at 10:00 it had dropped back to 34925, up 101. It rose to 35088, up 265 at 11:30, slipped back to 34590 at noon, and climbed back to 35080 before 1:30. It slipped back to 35000 at 3:15, then rose to 35095, a new all time intra-day hi, 9 minutes before the end of the session, which ended with a new all time closing hi.

This is a clearly up day, with the hi and lo up by 216 and 182 points, respectively. The span was 240.

The SP500 also had a clearly up day, with new all time intra-day and closing highs, as did the NASDAQ.

The Russell 2000 coiled around the neutral line until about 2:00, when it rose to close near the day's high. Unlike the other indexes, it had a mixed day, with the hi and lo both lower, contra the marginal higher close.

This has been a week of market incoherence – an erratic week with big drops on Monday and new highs on Friday. On Monday NYSE internals were very week. Yesterday they were not strong. Today, they are mixed, with both new highs and new lows above their 13 session averages. And, though advances greatly outnumbered declines, there was more decline volume. The question on Monday was follow-through. I guess we have the same question today.

Daily changes -

DJI30 +0.68%

SP500 +1.01%

NASDAQ +1.04%

Russell +0.46%

DJI Closings -

7/23/19 - 27349

7/23/20 – 26652

6/23/21 - 33874

7/23/21 – 35062

NYSE Internals -

A/D = 2046/1244 = 1.64

A/D Vol = 0.85

New Hi/Lo = 147/50 = 2.94