Monday, March 1, 2021

Green Arrow Up

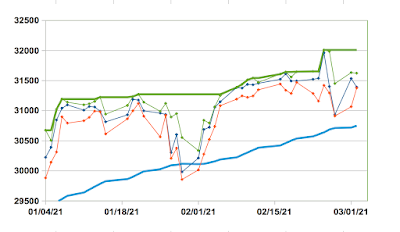

DJI30 Index at the close —- 31,535.51 +603.14 (+1.95%)

The index opened at 31066, up 134 points, and immediately shot to 31410, up 478. It then advanced more slowly, reaching a hi of 31634, up 701, at 11:20. It drifted slowly down, reaching 31475 at 1:15, then rose to the day’s hi of 31634 before 3:00, followed by a 98 point slide into the close.

So. the roller coaster ride continues. This is a clearly up day, with the hi and lo up by 183 and 155 points, respectively. The outsized magnitude to the gain at the close is because Friday’s session ended near the day’s lo, and today’s ended near the hi end. The span was 568 points. This is the 5th consecutive day of 490 or more.

The other indexes were up more, on a percentage basis, than the DJI, with the NASDAQ and Russell each gaining more than 3%.

% Changes -

DJI30 +1.95%

SP500 +2.38%

NASDAQ +3.01%

Russell 2000 +3.37%

DJI30 Closings -

03/01/19 - 26026

02/28/20 - 25409

02/01/21 - 30212

03/01/21 - 31536

NYSE Internals -

A/D = 2646/651 = 4.03

A/D Vol = 8.72

New Hi/Lo = 218/25 = 5.35

Tuesday, March 2, 2021

Red Arrow Down

DJI30 Index at the close —- 31,391.52 -143.99 (-0.46%)

The index opened at 31535, within a fraction of a point of yesterday’s close. After a 50 point drop, it climbed to 31623, the day’s hi, up 88. It then dropped to 31395, off 140. After a bounce to 31520 it dropped to 31379 at 11:40, then climbed to 31590, up 55. After a drop below 31500, it rose back to 31590 after 3:00. Then, it fell 198 points into the close, with the steepest fall in the closing minutes on a volume surge.

The value at the close is not disturbing on its own. But the hard drop at the end is. Remember, this is where the smart money operates. After 3 trips into positive territory, the close wound up only 14 points above the mid-day lo.

This is an inside day with the hi lower by 10 points and the lower higher by 311. Maybe there is some comfort in the lo rising for two days. The span was 246 points, less than half of yesterday’s 568, and the smallest since 187 on 2/19, the day the index changed by less than 1 point.

Momentum is lower by small amounts over the 5 to 21 day spans.

While the DJI was snaking around neutral, the other indexes spent the entire day in the red. The biggest decrease was in the Russell - of course.

New lows on the NYSE had been in the single digits for months, until the last couple weeks There were 89 today, the largest number since 98 on 10/28/20, when the market were falling just before the November rally that now seems to be getting old and tired.

The markets are skittish and fragmented. At least in the short term this does not seem healthy.

% Changes -

DJI30 -0.46%

SP500 -0.81%

NASDAQ -1.69%

Russell 2000 -1.93%

DJI30 Closings -

03/01/19 - 26026

03/02/20 - 26703

02/02/21 - 30687

03/01/21 - 31391

NYSE Internals -

A/D = 1394/1863 = 0.75

A/D Vol = 0.89

New Hi/Lo = 151/89 = 1.70

Wednesday, March 3, 2021

Red Arrow Down

DJI30 Index at the close —- 31,270.09 -121.43 (-0.39%)

The Index opened at 31353, off 39 points. It spent most of the day in the green, with a couple brief dips into negative territory before 10:30 and after 2:30. The hi was 31563 at about 1:20. But in the last 50 minutes of the session the Index dropped 216 points from 31486 into the close - again with the steepest drop in the closing minutes on a volume spike. The close was only 10 points above the day’s lo.

This is a clearly down day, with the hi and lo lower by 60 and 117 points, respectively. The span was 303. Momentum has turned down, with the 5 day duration falling hard, and the longer durations turning to follow. A short term top might be in. Last week’s early surge is looking like an aberration, with the trend turning the other way.

All the indexes were down, with the DJI suffering the least and the tech-heavy NASDAQ the most. The DJI and Russell 200 had similar contours, spending a large portion of the day in positive territory. The SP500 and NASDAQ we under water the whole time. The whole market is looking weak and wobbly.

Avi Gilbert, an Elliott Wave analyst who posts occasionally at Seeking Alpha says major support for the SP500 is 3800 to 3850. Today’s close is in that range, at 3819.72. A further slip below 3800 could lead to a test of the 3600 region. Either way, he expects a climb to 4300 later in the year. That represents a 13+% gain from the current valuation.

As things are going now, that slide to 3600 would not surprise me. There was a spike hi of 3588 on 9/02/20, and the index lingered in that area from mid November until it broke higher in early December.

Today’s chart is one year of the SP500 in an envelope one and two standard deviations above and below the 233 day EMA line. It’s been dancing above the +1 St Dev line since early November. A break to 3600 would not be a major correction - only about 8.3% from the 2/24 closing hi - but would clearly breach that line. He expects clarification before the end of the month.

% Changes -

DJI30 -0.39%

SP500 -1.31%

NASDAQ -2.70%

Russell 2000 -1.06%

DJI30 Closings -

03/01/19 - 26026

03/03/20 - 25917

02/03/21 - 30724

03/03/21 - 31270

NYSE Internals -

A/D = 1551/1730 = 0.90

A/D Vol = 1.06

New Hi/Lo = 276/70 = 3.94

Thursday, March 4, 2021

Red Arrow Down

DJI30 Index at the close —- 30,924.14 -345.95 (-1.11%)

The Index opened at 31289, up 19 points. It quickly rose to 31462, up 192, and the day’s hi. After a slide to 31152, off 118, at 10:20, it rose to touch the hi again a few minutes after noon. It then took a hard fall to 30548, off 723, at 2:00. From there it was a bumpy rise into the close.

This is a clearly down day, with the hi and lo lower by 101 and 713 points, respectively. The span was an astounding 914 points, the largest since 1125 on 9/03/20, when the index lost 808 points. And that entire 914 point drop happened in less than 2 hours. There may be some small comfort in the 129 point rise in the last 40 minutes.

Momentum is now clearly pointing down for all the time spans I look at. Today’s lo dropped under the 55 day EMA, and the close was only 104 points above it.

All the indexes were down today with the DJI suffering the least, and the Russell 2000 the most.

There were 154 new lows on the NYSE, the largest number in a year and a day. There were 180 on 4/03/20, when stocks crashed by over 30% in a little over a month. This is not looking good. But there may be some bargains soon [?]. Apple closed at 120.13. I’ll be interested at under 100, and will almost certainly buy under 90.

% Changes -

DJI30 -1.11%

SP500 -1.34%

NASDAQ -2.11%

Russell 2000 -2.76%

DJI30 Closings -

03/04/19 - 25820

03/04/20 - 27090

02/04/21 - 31056

03/03/21 - 30894

NYSE Internals -

A/D = 730/2554 = 0.29

A/D Vol = 0.44

New Hi/Lo = 166/154 = 1.04

Friday, March 5, 2021

Green Arrow Up

DJI30 Index at the close —- 31,496.30 +572.16 (+1.85%)

The Index opened at 31029, up 135 points, and immediately rose to 31259, up 365. It then turned and fell, hitting bottom at 30767, off 157, at 11:00. It then rose for 5 hours, hitting the hi of 31580 at 3:52. Note the 94 point drop in the closing minutes

This is a clearly up day, with the hi and lo higher by 118 and 219 points, respectively. The span was 814 points, 101 less than yesterday’s.

For the week, the Index was up 1.82%, most identical to today’s 1.85%

All the indexes had similar contours today, with the Russell 2000 gaining the most, and the DJI the least.

Short term momentum turned back up, but that might just be a zig, as the longer durations are still down.

% Changes -

DJI30 +1.85%

SP500 +1.95%

NASDAQ +1.55%

Russell 2000 +2.11%

DJI30 Closings -

03/04/19 - 25820

03/04/20 - 27090

02/04/21 - 31056

03/03/21 - 30894

NYSE Internals -

A/D = 730/2554 = 0.29

A/D Vol = 0.44

New Hi/Lo = 166/154 = 1.04

No comments:

Post a Comment