DJI30 Index at the close --- 34,869.63 +261.91 (+0.76%)

SP500 Index --- 4,468.73 +10.15 (+0.23%)

The DJI opened at 34665.5, up 58 points, and chopped up to the day's hi, 34039, up 331 at 10:45. It slid to the lo, 34665, up 58, at 2:15, ran mostly sideways for most of an hour, then rose into the close with a late volume surge.

This was an inside day, with the hi lower by 165 points, and the lo higher by 66. The spread was 274 points, 231 points smaller than Friday's.

The SP500 had a similar contour, at a lower pitch, dipped into the red in the afternoon, and finished with a smaller gain, also on increased volume. Despite the small gain, it had a mixed day with the hi lower by 27 points, and the lo lower by 12.

The NASDAQ started positive and quickly dropped into the red. It meandered in a mostly negative range for the rest of the day and finished with a small loss, climbing at the end on increased vollume. But it had a clearly down day by the substantial margins of 134 points at the top and 80 at the bottom

The Russell 2000 started positive, had a brief excursion into the red, then ran positive to end with a gain of over a half percent. Like the SP500, it had a mixed day with the hi lower by 19 points, and the lo lower by 10.

It's hard to know what to make of a day like this with a lack of coordination among the indexes. They are all below their recent highs, but well above their 8/19 lows. But only the NASDAQ remains above its trend line from the 3/23/20 low. This action looks like continuing consolidation; it really is several days of going nowhere. But – is it in preparation for the next leg up, or the prelude to a significant correction?

Daily % Changes -

DJI30 +0.76%

SP500 +0.23%

NASDAQ -0.07%

Russell +0.59%

DJI Closings -

9/10/19 - 26909

9/10/20 - 27535

8/10/21 - 35265

9/10/21 - 34608

NYSE Internals -

A/D = 2066/1234 = 1.67

A/D Vol = 2.37

New Hi/Lo = 88/36 = 2.44

The DJI opened at 34665.5, up 58 points, and chopped up to the day's hi, 34039, up 331 at 10:45. It slid to the lo, 34665, up 58, at 2:15, ran mostly sideways for most of an hour, then rose into the close with a late volume surge.

This was an inside day, with the hi lower by 165 points, and the lo higher by 66. The spread was 274 points, 231 points smaller than Friday's.

The SP500 had a similar contour, at a lower pitch, dipped into the red in the afternoon, and finished with a smaller gain, also on increased volume. Despite the small gain, it had a mixed day with the hi lower by 27 points, and the lo lower by 12.

The NASDAQ started positive and quickly dropped into the red. It meandered in a mostly negative range for the rest of the day and finished with a small loss, climbing at the end on increased vollume. But it had a clearly down day by the substantial margins of 134 points at the top and 80 at the bottom

The Russell 2000 started positive, had a brief excursion into the red, then ran positive to end with a gain of over a half percent. Like the SP500, it had a mixed day with the hi lower by 19 points, and the lo lower by 10.

It's hard to know what to make of a day like this with a lack of coordination among the indexes. They are all below their recent highs, but well above their 8/19 lows. But only the NASDAQ remains above its trend line from the 3/23/20 low. This action looks like continuing consolidation; it really is several days of going nowhere. But – is it in preparation for the next leg up, or the prelude to a significant correction?

Daily % Changes -

DJI30 +0.76%

SP500 +0.23%

NASDAQ -0.07%

Russell +0.59%

DJI Closings -

9/10/19 - 26909

9/10/20 - 27535

8/10/21 - 35265

9/10/21 - 34608

NYSE Internals -

A/D = 2066/1234 = 1.67

A/D Vol = 2.37

New Hi/Lo = 88/36 = 2.44

Tuesday, September 14, 2021

Red Arrow Down

DJI30 Index at the close --- 34,577.57 -292.06 (-0.84%)

SP500 Index --- 4,443.05 -25.68 (-0.57%)

The DJI opened at 34907, up 37 points, and a few minutes later reached the day's hi of 34990, up 121. From there it slid to the close in 3 steps, landing 67 points above the lo which occurred only a few minutes earlier, for a 292 point loss. This is an outside day, with the hi higher by 51 points and the lo lower by 155. The index broke below its 55 day EMA, and looks like it might be heading straight down.

The SP500 had a clearly down day, by 7 points at the top and 10 at the bottom. Its contour was roughly similar to the DJI's, with three bumpier steps down, and the lo just a few minutes before the close. Its trajectory now also looks like it is heading down. But it is still above its 55 day EMA.

The NASDAQ started positive and had another brief excursion into the green at noon before sliding into the day's lo at 3:30. It had a clearly down day by 34 and 22 points. It's still above its 55 day EMA, and slightly above its trend line from the 3/23/20 low.

The Russell 2000 had an outside day, up 5 points at the top, and down 13 at the bottom. It started positive, but quickly fell negative and had a similar downward downward sweep as the NASDAQ, hitting bottom after 3:30. It'

s below its 55 day EMA, and only about 50 points above the top of its resistance band.

This all looks bad and feels bad, but the indexes are still well above recent lows. There have been sharp mid-month lows in most of the Indexes in May, June, July and August. So maybe the current action is just continuing that trend. The rest of this week should tell us where we are heading. But NYSE internals were very week today, and that does not bode well. I'm DRIPping my portfolio of hi dividend paying stocks, and unless it looks like the end of the world, my plan is to ride it out.

Daily % Changes -

DJI30 -0.57%

SP500 -0.84%

NASDAQ -0.45%

Russell -1.37%

DJI Closings -

9/13/19 - 27220

9/14/20 - 27993

8/13/21 - 35515

9/14/21 - 34578

NYSE Internals -

A/D = 1022/2288 = 0.45

A/D Vol = 0.28

New Hi/Lo = 67/56 = 1.2

Wednesday, September 15, 2021

Greenish Arrow Upish

DJI30 at the close --- 34,814.39 +236.82 (+0.68%)

SP500 --- 4,480.70 +37.65 (+0.85%)

The DJI opened at 34581, up 3 points, and in the next few minutes fell to 34522, off 56. Evidently this completed a wave down as some small level of trend. The Index then rose, reaching 34715, up 137 after 10:00. After drawing back to 34590, up 12, the Index took off, reaching the hi of 34881, up 303, at 1:45. From there it meandered into the close, 66 points under the high.

This is, somewhat surprisingly, an inside day, with the high lower by 110 points, and the lo higher by 12. The span was 359 points, 121 points less than yesterday's. So this is really going nowhere. Today's close is 55 points under Monday's.

The SP500 had a clearly up day by the small margins of 1 and 3 points. It stepped higher the entire session, ending 6 points under the hi. This is the highest close in a week, but still under all the closes from 8/27 to 9/09. So – is this Index going anywhere? We need more data to decide.

The NASDAQ slogged along slightly in the red until a move up before 1:00. It then climbed to the hi after 3:30, 13 points above the close. The lo was right at the trend line from the 3/23/20 lo.

The Russell 2000 had an inside day with the hi lower by 13 points and the lo higher by 3. It had a choppy ride with a steady upward slant. Except for Friday's and yesterdays, today's hi was the lowest since 8/24.

All the indexes are, at best, going nowhere; and possibly in decline. Today approximately undid yesterday's losses, netting out to no meaningful information so far this week.

Daily % Changes -

DJI30 +0.85%

SP500 +0.68%

NASDAQ +0.82%

Russell +1.11%

DJI Closings -

9/13/19 - 27220

9/15/20 - 27996

8/13/21 - 35515

9/15/21 - 34814

NYSE Internals -

A/D = 2292/1005 = 2.28

A/D Vol = 2.6

New Hi/Lo = 74/48 = 1.54

Thursday, September 16, 2021

Yellow Arrow Sideways

DJI30 index at the close --- 34,751.32 -63.07 (-0.18%)

SP500 Index --- 4,473.75 -6.95 (-0.16%)

The DJI opened at 34810, off 4 points, and immediately jumped to 34944, up 129. From there it was a hard tumble, hitting the lo of 34540 before 11:00. It then climbed irregularly, reaching 34850, up 36, after 3:00. But then it slid 99 points for a 63 point loss. This is a mixed day with the hi and lo higher by 63 and 18 points, respectively. The span was 403 points.

All the indexes has roughly similar contours with a mid-morning low followed by a climb into the late afternoon. The SP500 had an inside day, with the hi lower by 1 point, and the lo higher by 5. It finished with a small loss. This is the 3rd straight day of topping out within a point of 4486. Could that be a resistance level.

The NASDAQ had a clearly up day by 31 and 64 points, and managed to stay positive at the end.

The Russell 2000 had an inside day with the hi lower by 13 points, and the lo higher by 3. It was not able to hold its late afternoon hi, and finished with a small negative.

All the daily changes were less than 0.2% This all continues the trend of going nowhere. The week's aimless volatility is attributed to options exposure tomorrow. We'll see.

Daily % Changes -

DJI30 -0.18%

SP500 -0.16%

NASDAQ +0.13%

Russell -0.07%

DJI Closings -

9/13/19 - 27220

9/15/20 - 27996

8/13/21 - 35515

9/15/21 - 34814

NYSE Internals -

A/D = 2292/1005 = 2.28

A/D Vol = 2.6

New Hi/Lo = 74/48 = 1.54

Friday, September 17, 2021

Red Arrow Down

DJI30 Index at the close --- 34,584.88 -166.44 (-0.48%)

SP500 Index --- 4,432.99 -40.76 (-0.91%)

The DJI opened at 34738, off 13 points, and slid to a lo of 34520, off 232 at 11:30. It bounced up from there at noon, reaching 34660, off 91 after 12:30. It slid again to 34520 again before 2:00, then galumphed sideways into the close, about 68 points higher. This is a clearly down day by 164 points at the top, but only 20 at the bottom. The span was 260. It broke below its 55 day EMA a few days ago, and now is about to drag the 13 day EMA along with it.

Coming off the 8/16 hi, this looks like the Index has experienced wave 1 down, wave 2 up to a lower hi at 35511 on 8/30, then sub waves I and ii of wave 3 down. If subwave ii is continuing, then we will get still more sideways motion into next week. But if subwave iii of 3 down is starting, the magnitude of the drop next week could be breath-taking. I'm no Elliott wave expert, and would very much like to be wrong about this. But I don't see any other way to read these tea leaves. A 5% decline off the 8/16 hi would land at 33850. A 10% decline would land at 32068. Red line support in the chart is at 33526, not far from the 5% level. A lower support line [not show] is at 31580, far under the 10% line.

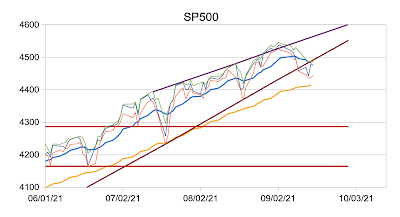

The SP500 had a similar contour and clearly down day by 14 and 16 points. The wave structure is less clear, but the Index is clearly heading down. It's only marginally above its 55 day EMA. A 5% decline off its 9/02 hi would land at 4319. A 10% decline would land at 4091. These values are close to the the red support lines on the SP500 chart. See the chart in yesterday's update. It the DJI falls hard, I don't see how the SP500 can resist following.

The NASDAQ also had a similar daily contour, and also appears to headed down on a larger scale. It is still about 175 points above it 55 day EMA, and this week's lows are right along the trend line from the 3/23/20 lo. A 5% decline from the 9/07 hi would land at 14633; 10% would land at 13863.

The Russell 2000 touched positive territory 3 times: at the start, just before 1:00, and again for a 4 point gain at the close. This is an inside day by 2 and 3 points, and a more explicitly sideways move than the other indexes had. The 5% loss level from the 3/15 hi is 2242. The Index has dropped below that level several times, and is a couple points under that level today. The 10% level is at 2124, near the bottom of the support region on its chart.

This week's strongest showing was a pretty tepid upside move on Wednesday. Everything looks pointed down from here. Pretty poor way to end the week.

This was a triple witching day, so NYSE volume was about 31/2 time the recent average. Internals were quite weak.

Weekly % Changes – not much

DJI30 -0.06%

SP500 -0.06%

NASDAQ +0.13%

Russell -0.07%

Daily % Changes -

DJI30 -0.48%

SP500 -0.91%

NASDAQ -0.91%

Russell +0.18%

DJI Closings -

9/17/19 - 27095

9/17/20 - 27902

8/17/21 - 35343

9/17/21 - 34587

NYSE Internals -

A/D = 1190/2085 = 0.57

A/D Vol = 0.46

New Hi/Lo = 77/30 = 2.57

No comments:

Post a Comment