It is in excess reserves. Not exactly every last penny, but the great vast majority.

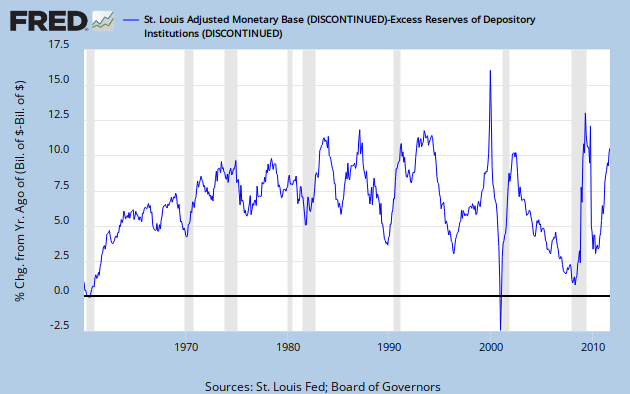

His comment to graph #3 at his link: "Base money less excess reserves shows a gradual uptrend. Almost like normal growth." This got me wondering what normal growth actually is. The graph below illustrates YoY % growth in {base money - excess reserves} (FRED series AMBSL - series EXCRESNS)

First observation: The growth number varies a lot, but is between 5 and 10% most of the time since the mid 60's.

Second observation: Without prior knowledge, there is absolutely no way to detect any QE event on this graph - exactly to Art's point.

Third observation: The rate of change always increases during a recession, from the very minor uptick in 1974 to the quite dramatic upticks of 2001 and 2009. But there's also a big, narrow spike in the late 90's, and significant bumps in the mid 80's and early 90's - all non-recessionary times.

Fourth observation: The rate of change increased steadily from zero to about 6% during the 60's. Since then it looks like about a 7.5% average, BUT - with an increasing standard deviation.

I don't know what to make of this history, but the clear message of more recent events is that the apparent big cash infusions of QE (see Art's graph #1) were no infusions at all. The net result is that banks, by drawing a small but real return on excess reserves have further enriched themselves while doing no good at all to the economy at large. This is just one more - and very subtle - form of rentier activity.

Bottom line: We are so screwed.

Update: Just for Kicks, here are the monetary base and the monetary base less excess reserves for the period 1960 through the end of 2007. Both lines are plotted, but they overlap completely.

Now, here they are for 1/1/2008 on. Not so much overlap now.

Update 2: In comments, Nanute says: "Does it not seem that all the QE money has had the perverse effect of slowing down the velocity of money? By paying interest on excess reserves the Fed is basically allowing banks to profit from borrowing from the government. It's like free money."

Indeed. A look at this FRED graph (normalized to 100 at 1/1/2005) shows how velocity for all the money measures has tanked since 2008. From Art's earlier post, QE initiation dates are Sept. '08 and Nov. '10. In fairness, we have to note that velocity for M1 and M2 had been sliding since early '06. Not so for MZM, though, which rose steadily until late in 2007.

Correlation isn't causation, but we can safely say that two rounds of QE did nothing to increase money velocity, for any money measure.

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/tny_au_xx_usoz_4.gif)

7 comments:

Jazz,

Good observations.

That big narrow spike in the late 1990s must have something to do with Y2K worries. And yes -- two bumps in the 1980s and one in the early 1990s. I keep coming back to these bumps myself.

Also note the uptrend of the late 1990s (when the economy was good) and the downtrend of the first decade of the 2000s (when it was not good). There was a similar downtrend during the roaring '20s, by the way.

Isn't it odd that Base growth was near zero in 1960? And now that you mention it, near zero pretty much all through the 1950s. Maybe they didn't need base because there was still so much WWII federal debt money in the economy that they didn't need base growth. And/or because of the Depression-and-wartime growth of the base.

Base money growth is a mid-course correction, generally applied too late: after a crash signals that there was indeed a problem after all.

We've known for a very long time now that they were sitting on this or had never even gotten any funds for actual investment.

Are you marching yet?

I am.

Love ya,

S

Jazz..

Does it not seem that all the QE money has had the perverse effect of slowing down the velocity of money? By paying interest on excess reserves the Fed is basically allowing banks to profit from borrowing from the government. It's like free money. Why not target the discount rate, making it more expensive to hold excess reserves? How much borrowing is being done through the bank to bank, Fed funds rate versus the borrowing from the government through discount rate?

Art -

I will have to admit to being fundamentally quite ignorant about money.

Susan -

No, not marching. I kvetch a l lot, though.

Nanute -

Good points. See update 2.

Cheers!

JzB

When I first heard, a couple of years ago, that the Fed was going to start paying interest on its deposits, I went "say WHA?!" and yeppers, exactly what I predicted happening has happened.

At which point the question is, why? Why has the Fed done this? It's as if Bernanke is giving with one hand, and taking back with the other, sending money on a loop thru the economy for no real effect that I can see other than to plump up bank balance sheets. Maybe that's all he was trying to do, but surely there's better ways to do that? Hmm...

- Badtux the Baffled Penguin

nike shoes

yeezy boost 350

yeezy boost 700

adidas tubular

ferragamo belt

golden goose

golden goose outlet

yeezy boost 350

huaraches

nike kd 11

kd13

hermes handbags

stephen curry shoes

supreme clothing

giannis antetokounmpo shoes

nike x off white

golden goose

golden gooses

supreme new york

jordan shoes

Post a Comment