Monday, August 9, 2021

Orange Arrow Down a littleDJI30 Index at the close ---

35,101.85 -106.66 (-0.30%)SP500 Index ---

4,432.35 -4.17 (-0.09%)The DJI opened at 35230, up 21 points, and the days hi. It dropped, hitting the day's lo, 35041, at 10:30, and neve saw green again. It rose near 35150, off 59 points, at noon, and stayed near that level until after 3:00, when it took a roller coaster ride into the close. This is a clearly down day by the small margins of 17 and 36 points. And by those margins is off from Friday's all time highs. The span was a rather modest 188.

The SP500 also started in the red, had a roughly similar contour, and touched green for an instant at 2:30 before settling into a minuscule loss. It also had a clearly down day, by 1.4 and 4.3 points. And by those margins is off from Friday's all time highs.

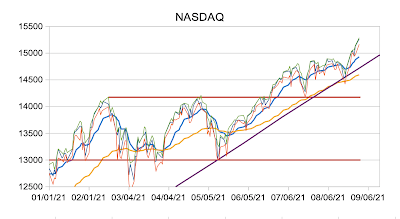

The NASDAQ started slightly negative, quickly moved into positive territory and stayed there the rest of the session. It had an inside day, with the hi lower by 6 points, and the lo higher by 14. It's only slightly below the all-time highs achieved on Thursday

The Russell 2000 started negative and stayed there all day. It had a clearly down day by small margins, and had the day's largest percentage loss. It's about in the middle of its trading range since February.

This was a rather ho-hum day of small moves on below average volumes. I don't think we learned much

% Changes -

DJI30 -0.30%

SP500 -0.09%

NASDAQ +1.16%

Russell -0.58%

DJI Closings -

8/05/19 - 26287

8/07/20 - 27433

7/09/21 - 34870

8/09/21 - 35102

NYSE Internals -

A/D = 1251/2038 = 0.61

A/D Vol = 0.72

New Hi/Lo = 110/29 = 3.79

Tuesday, August 10, 2021

Green Arrow up

DJI30 Index at the close --- 35,264.67 +162.82 (+0.46%)

SP500 Index --- 4,436.75 +4.40 (+0.10%)

The DJI opened at 35135, up 33 points. After a quick dip to 35092, off 10, it rose, hitting 35265 before 10:30. The rest of the day, it wound around 25250, with a 25 point rise into the close. This is a clearly up day by 55 and 51 points. The span was 193. This was enough to give the Index new intra-day and closing highs by 38 and 56 points

The SP500 had a similar morning, with a mid-morning slip into negative territory and a recovery to the opening value around noon. But it slid all afternoon, ending with a tiny up-tic on a volume surge that moved it from neutral to a small gain. It had a clearly up day by about 5 points at either end. This was enough to squeak out new highs by 4 ½ points intra-day and a half point at the close.

The NASDAQ opened slightly positive, dropped negative and stayed there, hitting the lo after 11:00. It made a partial recovery until noon, then slid the rest of the day. It had an inside day by small margins.

The Russell 2000 dipped briefly into the red before 10:00, rose to a hi before noon, then moved mostly sideways with a slight downward bias the rest of the day. It had a mixed session, with the hi and lo each down by about 2 points, and a 5 point gain at the close.

Even with some new highs this was a rather uneventful day. The most notable thing was that each index followed its own path. So nonconformance continues.

% Changes -

DJI30 +0.46%

SP500 +0.10%

NASDAQ -0.49%

Russell +0.20%

DJI Closings -

8/05/19 - 26287

8/07/20 - 27433

7/09/21 - 34870

8/09/21 - 35102

NYSE Internals -

A/D = 1788/1525 = 1.17

A/D Vol = 1.81

New Hi/Lo = 160/48 = 3.33

Wednesday, August 11, 2021

Green Arrow Up

DJI30 Index at the close --- 35,484.97 +220.30 (+0.62%)

SP500 Index --- 4,447.70 +10.95 (+0.25%)

The DJI opened at 35301, up 36 points, and 20 minutes later reached 35491, up 227, and a new intra-day hi. At 11:45 it slid to 35410, up 145. It went sideways between those values through the end of the session, for a 222 point gain. This gives us new all time highs, by 216 intra-day and 220 at the close.

This was a clearly up day, by 216 and 209 points. The spread was only 200.

The SP500 was close to flat all day, but was still clearly up, eking out new all time highs by about 4 points intra-day and 9 points at the close.

The NASDAQ opened positive then quickly fell negative, and stayed there for the rest of the day. It rose all afternoon from a mid-day minimum, finishing with a small loss. It had a clearly down day.

The Russell 2000 started up less than a point, had a minimum near mid-day, then rose and finished positive by 11 points.

Again, the contours were dis-similar.

% Changes -

DJI30 +0.62%

SP500 +0.25%

NASDAQ -0.16%

Russell +0.49%

DJI Closings -

8/09/19 - 26287

8/11/20 - 27687

7/09/21 - 34870

8/11/21 - 35488

NYSE Internals -

A/D = 2205/1084 = 2.03

A/D Vol = 2.37

New Hi/Lo = 160/34 = 5.29

Thursday, August 12, 2021

Orange Arrow Sideways

DJI30 Index at the close --- 35,499.85 +14.88 (+0.04%)

SP500 Index --- 4,460.83 +13.13 (+0.30%)

The DJI opened at 35482, off 3 points, and 15 minutes later hit the hi of 35511, up 26. It then fell, hitting the lo of 35353, off 132. shortly after 10:00 and again shortly after 11:00. It then rose, and from 12:15 until 2:45 it went sideways between 35420 and 35460. It then rose on volume surges at 3:30 and the close, ending with a tiny gain.

This is a clearly up day, with the hi and lo higher by 10 and 52 points. The spread was 158 points, the smallest since 142 on 7/13.

The SP500 started negative, moved positive before noon and kept climbing, ending with a .3% gain. This was an outside day by 12 points at the top and a half point at the bottom. These small gains were enough to cause new all time highs by about twelve points both intra-day and at the close.

The NASDAQ had a contour similar to the SP500, starting negative and after a dip moving mostly positive the rest of the session. It had an inside day, and therefore no new highs.

The Russell 2000 started negative, slumped, the snaked upward the rest of the day, but never reached positive territory. It has been trading in a narrow range for since 7/20.

It's every index for itself.

% Changes -

DJI30 +0.04%

SP500 +0.30%

NASDAQ +0.35%

Russell -0.28%

DJI Closings -

8/09/19 - 26287

8/11/20 - 27687

7/09/21 - 34870

8/11/21 - 35488

NYSE Internals -

A/D = 1511/1764 = 0.86

A/D Vol = 0.66

New Hi/Lo = 162/43 = 3.77

Friday, August 13, 2021

Yellow Arrow Sideways

DJI30 Index at the close --- 35,515.38 +15.53 (+0.04%)

SP500 Index --- 4,468.00 +7.17 (+0.16%)

The DJI opened at 31552, up 52 points. It reached a hi of 35611, up 111, less than 20 minutes later. Shortly after 10:00 it fell to a lo of 35486, off 14. It climbed back up to 35550 at 11:15, and ran mostly sideways until 2:00 when it turned down and oscillated to a lo of 35475 at 3:55. It then rose 41 points into the close on a volume surge. Since mid June the Index has held below the bottom of what was its up-slanting trend channel.

This is a clearly up day by 100 points at the top and 122 at the bottom. But the span is only 136 points, the smallest of the year. This results in new all time highs, by 109 points intra-day, and 30 points at the close. In this context, the puny 14 point gain is confusing.

The SP500 was basically flat all day, trading in a range of only 7.55 points. But this was enough to result in new all time highs by 6.6 points intra-day and 7.17 at the close.

The NASDAQ had a clearly up day by 26 points at the top and 98 at the bottom. It crossed neutral several times and finished with a 6.64 point gain.

The Russell 2000 was negative all day and slid at the finish, losing almost a percent.

% Changes -

DJI30 +0.04%

SP500 +0.16%

NASDAQ +0.04%

Russell -0.93%

DJI Closings -

8/09/19 - 26287

8/11/20 - 27687

7/09/21 - 34870

8/11/21 - 35488

NYSE Internals -

A/D = 1568/1721 = 0.91

A/D Vol = 0.73

New Hi/Lo = 169/44 = 3.84

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/tny_au_xx_usoz_4.gif)