Monday, August 30, 2021

Yellow Arrow Sideways

DJI30 Index at the close --- 35,399.84 -55.96 (-0.16%)

SP500 Index --- 4,528.79 +19.42 (+0.43%)

The DJI opened at 35472, up 17 points, then fell, hitting a lo of 35374, off 80 at 10:00. It then climbed, hitting a hi of 35511, up 56, at 11:15. From there it was a long, slow 112 point slide into the close, with a small loss.

This was a mixed day, with the hi higher by 32 points and the lo higher by 143. The span was a narrow 136.

The SP500 hovered near its late afternoon hi until after 3:00 when it slid by about 8 points into the close. It had a clearly up day by 34 and 39 points. This resulted in a new intra-day by 24 points, and a new closing hi by 19.

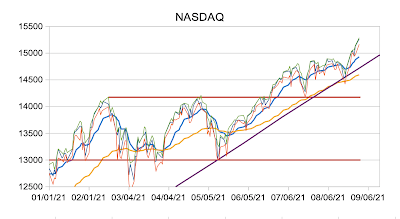

The NASDAQ reached its high after 3:00, with a slight slump into the close. It had a clearly up day by 144 and 199 points; and it reached new all time highs by 144 and 137 points.

The Russell 2000 dropped quickly in the first half hour, then slid more sowly the rest of the day, ending with a half percent loss. But it had a mixed day, with the hi higher by 5 points, and the lo higher by 51.

All together, this was a confusing session. The SP500 and the NASDAQ reached new highs. The DJI and Russell were down at the close, but higher at their highs and lows. My conclusion is that the broad thrust is still up for all the indexes.

% Changes -

DJI30 -0.16%

SP500 +0.43%

NASDAQ +0.90%

Russell -0.4%

DJI Closings -

8/30/19 - 25403

8/28/20 - 28332

7/30/21 - 34935

8/30/21 - 35400

NYSE Internals -

A/D = 1411/1871 = 0.75

A/D Vol = 0.66

New Hi/Lo = 194/31 = 6.28

Tuesday. August 31, 2021

Yellow Arrow Sideways

DJI30 Index at the close --- 35,360.73 -39.11 (-0.11%)

SP500 Index --- 4,522.68 -6.11 (-0.13%)

The DJI opened at 35391, off 8 points, reached a hi of 35450, up 50, then slid the rest of the day to end up 31 points under the opening. This is a clearly down day by 61 and 85 points. After the 8/16 hi and the 8/24 local lo, the Index might now be in a counter-current corrective wave at some low level of trend. The short term challenge is to stay above the up-slanting trend line.

The SP500 mirrored the DJI, and ended with a near identical result. It had an inside day with the the hi lower by 6 points, and the lo higher by 2. These values are clustered closely around the upper trend line, slightly below yesterday's all time highs.

The NASDAQ spent most of the day in the red, with a couple briefs pops above neutral, and ended slightly negative. It had an inside day, lower by 9 points at the hi, and higher by 37 at the day's lo. After a string of new all time highs, today's finish is slightly under the peak.

The Russell 2000 made a brief excursion into negative territory, then spent the rest of the day in the green, and closed near the day's hi. It had a mixed session with the hi and lo lower by 9 and 4 points, respectively, contra the 8 point gain at the close.

This still looks like a pause in the top level upward trend. As always, follow-through is important, so tomorrow deserves a close watch.

NYSE volume was more than 50% above average today. I never noticed this before, but it seems to be a regular occurrence on the last trading day of the month.

Some economic reports come out this week: the ADP job report and the ISM manufacturing report tomorrow, then the BLS job report and the services ISM report on Friday. Presumably, the FED can be influenced by these data.

% Changes -

DJI30 -0.11%

SP500 -0.13%

NASDAQ -0.04%

Russell +0.34%

DJI Closings -

8/30/19 - 25403

8/31/20 - 28430

7/30/21 - 34935

8/31/21 - 35338

NYSE Internals -

A/D = 1837/1466 = 1.25

A/D Vol = 1.50

New Hi/Lo = 147/33 = 4.45

Wednesday, September 1, 2021

Yellow Arrow Sideways

DJI30 Index at the close --- 35,312.53 -48.20 (-0.14%)

SP500 Index --- 4,524.09 +1.41 (+0.03%)

The DJI opened at 35388, up 27 points. It dropped to the lo of 35287, off 74, before 11:30, climbed to the hi of 35407, up 37, before 1:00. It slid a little lower for an hour and a half, then fell harder into the close for an 48 point loss. As somewhat of a small bright spot, there was a 25 point rise in the closing moments on a modest volume surge.

This is a clearly down day by 42 and 3 points.

The span was a moderate 120. The index has been drifting down from the 8/30 hi, but is still above 8/27 lo. The range of 35250 to 35300 has been touched a few times in the last 5 trading days, from both sides. This might be a support level to look for, short term

The SP500 was in the green all day, peaking in early afternoon, then mimicking the DJI into the close, including a higher volume blip up at the end, resulting in a minuscule gain of less than a point and a half. It had a clearly up day by about 6 points at either end, and missed new highs by a quarter point intra-day and 5 points at the close.

The NASDAQ also reached it peak in early afternoon, then fell into the close. But it had a clearly up day, and not by a little – 100 points at either end. It also achieved new highs, by 91 points intra-day and 43 at the close.

The Russell 2000 opened slightly positive, dipped briefly into the red, reached a hi in early afternoon, then ran mostly flat with a slight slump, finishing with a gain of over a half point. It had a clearly up day by 16 and 4 points, and was today's big winner.

Every index followed its own path to its own conclusion, with non-conformances everywhere..

DJI30 -0.14%

SP500 +0.03%

NASDAQ +0.33%

Russell +0.58%

DJI Closings -

8/30/19 - 25403

9/01/20 - 28646

7/30/21 - 34935

9/01/21 - 35312

NYSE Internals -

A/D = 2054/1260 = 1.63

A/D Vol = 1.22

New Hi/Lo = 186/19 = 9.79

Thursday, September 2, 2021

Green Arrow Up

DJI30 Index at the close --- 35,443.82 +131.29 (+0.37%)

SP500 Index --- 4,536.95 +12.86 (+0.28%)

The DJI opened at 35353, up 41 points, and immediately rose to 35468, up 155. After a decline, it rose to the hi of 35475, up 163, before 11:00. It slipped back to 35350 after 2:30, bounced above 35400 at 3:00, slipped back to 35350 a couple times after 3:30, then rose 95 points in the closing moments, resulting in a small gain.

After 3 downish, but basically sideways days, this is a clearly up day by 68 and 61 points. The span was 126 points. This was the 4th consecutive session of 160 or less.

The SP500 had a similar contour and a clearly up day by 9 and 3 points. These small margins were enough to achieve new highs by about 8 points, both intra-day and at the close.

The NASDAQ also had a roughly similar contour, but dipped briefly into the red at the afternoon lo. It finished with the day's smallest gain. This was an outside day with the hi higher by less than a point, and the lo lower by 22. But this was enough to provide new highs, by 0.57 point intra-day and 22 points at the close.

The Russell 2000 also had a somewhat similar contour, but with a smaller afternoon dip, and less of a rise at the end. It had a clearly up day by 17 and 23 points. It is now only 50 points under its all time intra-day hi, and 56 at the close, both from 3/15.

NYSE internals were quite strong today.

% Changes -

DJI30 +0.37%

SP500 +0.28%

NASDAQ +0.14%

Russell +0.74%

DJI Closings -

8/30/19 - 26403

9/02/20 - 29101

8/02/21 - 34838

9/02/21 - 35444

NYSE Internals -

A/D = 2131/1125 = 1.89

A/D Vol = 2.07

New Hi/Lo = 251/18 = 13.94

Friday, September 3, 2021

Yellow Arrow Sideways

DJI30 Index at the close --- 35,369.09 -74.73 (-0.21%)

SP500 Index --- 4,535.43 -1.52 (-0.03%)

The DJI opened at 35402, off 42 points, and fell to a low of 35269, off 174 at 10:00. It reached a hi of 35423, off 21 after 11:00, then slid to 35340 at noon and ran sideways for an hour. It reached the hi again after 2:00 and ran sideways until after 3:00, followed by a 55 point drop into the close, on a volume surge.

This is a clearly down day by 53 and 79 points. The spread was 153 points. This entire week has been in a tepid trading range of only 224 points. It looks as if a complex corrective wave is still playing out, and will be as long as the index stays below the 8/16 hi of 35631. And we don't need to be concerned about a larger correction [or worse] as long as it stays above the 8/19 lo of 34690.

The SP500 Started in the red, went slightly positive in the afternoon, then slid at the end for a tiny loss. It had a clearly down day by the small margins of 4 and 3 points.

The NASDAQ started slightly negative, but quickly went positive and stayed there, ending with a small gain. It was a mixed day, with the hi and lo lower by about 4 points at either end, but a finish near the top of the range for a 32 point gain and a new all time hi by the same amount.

The Russell 2000 had a clearly down day by 6 points at the top and 1 at the bottom. But it closed near the bottom of the range for a half percent loss.

This was a confusing day to top off a confusing week. Markets are closed Monday for Labor Day.

Weekly % Changes

DJI30 -0.24%

SP500 +0.58%

NASDAQ +1.55%

Russell +0.62%

Daily % Changes -

DJI30 -0.21%

SP500 -0.03%

NASDAQ +0.21%

Russell -0.52%

DJI Closings -

9/03/19 - 26118

9/03/20 - 28293

8/03/21 - 35116

9/03/21 - 35369

NYSE Internals -

A/D = 2131/1125 = 1.89

A/D Vol = 2.07

New Hi/Lo = 251/18 = 13.94

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/tny_au_xx_usoz_4.gif)

No comments:

Post a Comment