Foreword

Unlike right-wingers, frex. Amity Shlaes, I like to get things right. In fact, when one is refuting a liar's lies, I believe its important to be meticulously correct. Hence this rework of my previous post.

As I was thinking about Graph 3, it occurred to me that the numbers there were far too small, around 100 million at the maximum, when they should be in the billions. I'm not sure what that graph represents, but it is certainly not the total of income tax revenues. That sent me on a quest to find better numbers, which I did. You will find them in Graph 3 and 4 of this rewrite. Much to my chagrin, I also found I put the wrong data in Graph 2, now corrected here. Since I want to cross-post this at Angry Bear, I've also made a few editorial changes to make it more Bear-worthy.

~ : ~ : ~

Amity Shlaes, the

disinformation bunny, is still going. In the latest issue of

Imprimus, a publication of

Hillsdale College, is a transcript adapted from a recent talk she gave there during a conference on the Income Tax, sponsored by Hillsdale's own

Center for Constructive Alternatives and the

Ludwig von Mises Lecture Series. Right away, you know this is going to be good. The Title of her contribution is

Calvin Coolidge and the Moral Case for Economy. Of course, by economy, she means austerity.

There is so much wrong here it's both impressive and depressing. Rather than give her the full

FJM treatment,

which would take more time and energy than she deserves, I'll just hit

on a couple of the lowlights. Here is her opening paragraph.

With

the Federal debt spiraling out of control, many Americans sense an

urgent need to find a political leader who is able to say "no" to

spending.

Here we go. Her first sentence is an exercise in made-up right-wing talking point mythology. I've already exploded the '

Obama is a profligate spender" myth,

here,

here, and

here. Further, we have just lived through three years when federal spending was close to flat line, as Graph 1 shows.

Graph 1 - Flat Federal Spending Under Obama

There

is only one comparable period in post WW II history, 1953-56, during Eisenhower's first term, as shown in Graph 2. Still, over Ike's full term, spending grew by about 30%.

Graph 2 Not So Flat Spending Growth Under Eisenhower ('53-'60)

To

suggest that federal dept is now "

spiraling out of control" due to excessive spending is not merely

disingenuous. It is a sign that either Shlaes has no earthly idea what

she's talking about, which in an alleged journalist, is unforgivable, or

it's a bare-faced lie, which is unforgivable for anybody. And if many

Americans are feeling the urgent need to curtail government spending, it's because

they have been lied to so repeatedly and often that

they have no idea what the truth is. As

Krugman recently put it: "

And I have to say, it’s extremely telling that conservative Republicans

don’t seem able to make their case without resorting, right from the

beginning, to obviously dumb fallacies." The truth is that if we have a debt problem, it is due to

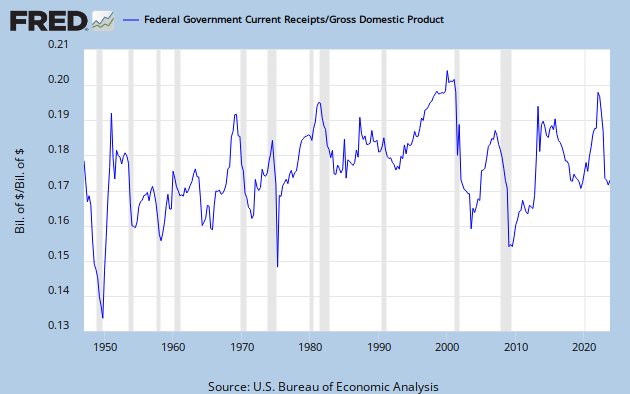

a shortfall in revenues.

Yet they fear that finding such a leader is impossible.

Its

not clear who made Shlaes the spokesperson for this sorry,

disenfranchised segment of the population, nor that this is indeed what

they fear. Perhaps we should introduce Shlaes and the rest of these

Real Americans to the

real President B. Hoover Obama.

Conservatives long for another Ronald Reagan.

This

is probably correct, though as Shlaes goes on to demonstrate,

conservatives in this way - and, alas, right-wingers almost always - are rather badly

disconnected from reality.

He

was of course a tax cutter, reducing the top marginal rate from 70 to

28 percent. But his tax cuts - which vindicated supply side economics

by vastly increasing federal revenue - were bought partly through a

bargain with Democrats who were eager to spend that revenue.

Wrong again. The reality is that

Revenue growth under Reagan was the worst

of any 20th century President, post Eisenhower, except for the

unfortunate Bush, Sr. under who's recession plagued regime Reagan's buzzards came home to

roost. And was it really the Democrats who spent that anemic revenue

stream, or did it go to Reagan's Star Wars fantasy?

Reagan was no budget cutter. In fact, the federal budget grew over a third during his administration.

Here, she finally gets something right, if by "federal budget" she means Total Outlays, and by "over a third"

she means over 80% [as measured from 1980 to 1988.]

Things get really egregious further on in the section titled "

The Purpose of Tax Cuts."

She informs us that President Coolidge and Treasury Secretary Andrew

Mellon campaigned to lower top rates from the 50's to the 20's.

Mellon

and Coolidge did not win all they sought. The top rate of the final

law was in the forties. But even this reduction yielded results - more

money flowing into the treasury - suggesting that "scientific taxation"

worked. By 1926, Coolidge was able to sign legislation that brought the

top marginal rate down to 25%, and do so retroactively.

I was surprised to learn that Coolidge and Mellon had anticipated the Laffer curve by 6 decades. Let's have a look at how more money flowed into the treasury. In 1922 and '23, with a

top marginal rate of 56%,

tax revenues were $2.23 and 1.69 billion respectively. [Per FRED, 1923 was a recession year] In 1924, with a top rate of 46%, total revenues were $1.79 billion. This is what Shleas calls "

more

money flowing into the treasury." Here's a bigger picture look. In 1920, when

the top marginal rate was 73%,

receipts were slightly over $4 billion. In 1925, when the top marginal rate

was 25%, receipts were $1.7 billion, less than half of the 1920 value, and by 1929 had only increased to 2.23 billion. Graph 3 shows revenues per year [Coolidge's term highlighted in red,] and belies Shlaes' assertion.

Graph 3 Income Tax Revenues, 1915-1930

Graph 4 shows a scatter plot of this same data, with revenues as a function of top marginal rate, Coolidge years are again highlighted in red.

Graph 4 Top Marginal Rate and Tax Revenues, 1915-1930

A best fit straight line is included. There's lots of scatter, for a variety of reasons, but the upward trend - the exact opposite of Shleas' assertion, is obvious.

So here's the reality. A decade of tax cutting and deregulation led

us into the Great Depression, the worst economic collapse of the 20th

century. [You might note that the following decades of high tax rates

and robust regulation were free of these horrible events.] And what

happened most recently? A decade of tax cuts and deregulation - the end

game of three decades of this supply-side approach - led to the

greatest economic collapse since the Great Depression. Significantly,

the major deregulations of big finance, including the repeal of Glass-Steagall came at the end of Clinton's

term, less than a decade prior to the financial melt down. Last Friday on his radio show, Thom Hartmann pointed out that prior to the regulations put in place in the 30's, the U.S. had never gone for more than 15 years without a major financial collapse. So this result should have been expected.

The

extraordinary thing isn't that right wingers lie. The simple reality

is that they can't make their case without lying, because it has no

merit. The extraordinary thing is that their lies are so easily rooted

out and refuted, in the era of free and easily accessible information,

but so few people will take the required few minutes to go ahead and do

it. Sadly, whenever the truth comes up against a cascade of lies,

the liars have a significant tactical advantage.

Shlaes' presentation is just one more

manifestation of the right wing ploy of denying reality. Sadly, it

works, because you really can fool a lot of the people a lot of the

time.

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/tny_au_xx_usoz_4.gif)