Monday, January 4, 2021

Red Arrow Down

DJI30 Index at the Close —- 30,223.89 -382.59 (-1.25%)

The Index opened at 30627, up 21 points, and quickly rose to 30674, up 68, making yet another intra-day hi. A steep decline followed, hitting a lo of 30018, off 588 around 11:00. After a slight bounce to 30150, the fall resumed, hitting another lo of 29882 at 12:15. The Index rattled around under 30000 for an hour, then again rebound to about 30150 before 1:30. It hovered around 30100 until 3:30, then rose to the afternoon hi of 30256 before sliding 34 points into the close. This represents a recovery of 47.2% of the drop from the early morning hi to the mid-day lo.

This is an outside day, with the hi up by 37 points and the lo down by 463. The span was 792 points, the largest since 803 on the big up-surge day of 11/09.

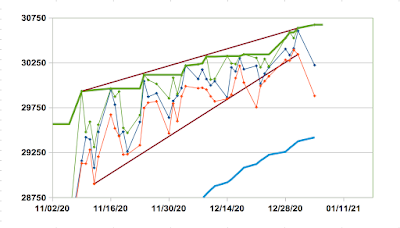

Today’s dramatic and impulsive-looking drop breaks the up-slanting wedge, with the lo and close landing well below it, and should be the beginning of a leg down. Declines of 5, 10, 15 or 20% from this morning’s hi would land at 29141, 27607, 26073 or 24539, respectively. I’m not predicting anything, just pointing out some possibilities. But, given the extremes all the indexes have achieved in the last few days, I doubt that 5% would be an adequate correction. Also but, I do have a bearish bias, so take that with a kilo of salt.

Yet another but - almost all of the few dozen individual stocks I’m tracking peaked on or before December 18th, and since then have drifted sideways or slid a bit, so down is looking a lot more likely than up - at least in the short term.

Momentum is down slightly from last Thursday’s local hi, but is still broadly sideways. Today’s close and low are well within the trading range observed since mid-December. One day isn’t going to do much to that picture.

If I’m reading this situation right, early tomorrow there might be a slight move up to reach a 50% retracement of the drop, or a larger move up to 30372, reaching a 61.8% retracement [though neither of those is necessary] before the next leg of the drop. There are other possibilities that will be addressed if they arise. There might be a support band at 29750 to 29980. There are several daily lows in that range since late November. But that is only a drop of 3% or less, and would not be much of a correction.

% Changes -

DJI30 -1.25%

SP500 -1.48%

NASDAQ -1.47%

Russell 2000 -1.47%

DJI30 Closings -

01/04/19 - 23433

01/03/20 - 28635

12/04/20 - 30218

01/05/20 - 30224

NYSE Internals -

A/D = 913/2254 = 0.41

A/D Vol = 0.46

New Hi/Lo = 167/5 = 33.40

Tuesday, January 5, 2021

Yellow-Green Arrow Up

DJI30 Index at the close —- 30,391.60 +167.71 (+0.55%)

The Index opened at 30204, off 20 points, and quickly shot up to 30386, up 163. It chopped down from there for a half hour, then fell sharply, hitting the day’s low of 30142 at 10:45, and approaching that level again a half hour later. It climbed back to 30350 around noon and hovered near there until 2:00 when it surged up hitting the day’s hi of 30505, up 281points, between 2:00 to 2:30. From there it was a jagged 113 point drop into the close.

This is an inside day, with the hi lower by 169 points and the lo higher by 260. The span was 363 points, 46% of yesterday’s 792. Yesterday I mentioned a possible .618 retracement, which was exceeded this afternoon. Another possibility that I hinted at was a higher level retracement, and that is what happened. The hi of 30505 was 623 points above yesterday’s lo. This is a .786 retracement of the drop from yesterday's early morning hi. This is a less common, but recognized retracement level — .786 is the square root of .618, and today’s hi hit it exactly.

Either this is an extremely weird coincidence, the counter-current has been achieved and the next move is down, or I have this completely wrong. The next few days will sort this out.

% Changes -

DJI30 +0.55%

SP500 +0.71%

NASDAQ +0.95%

Russell 2000 +1.71%

DJI30 Closings -

01/04/19 - 23433

01/03/20 - 28635

12/04/20 - 30218

01/05/21 - 30392

NYSE Internals -

A/D = 2291/872 = 2.63

A/D Vol = 3.31

New Hi/Lo = 114/4 = 28.5

Wednesday, January 6, 2021

Green Arrow Up

DJI30 Index at the Close —- 30,829.40 +437.80 (+1.44%)

The Index opened at 30363, off 29 points. After that, it was a steady climb to 30933 at 11:15. It stayed below that level until 12:30, then rose again, hitting the hi of 31022, up 631 at 1:15. It stayed above 30950 until 2:15. At 2:45 it dropped to about 30750. From there, it was a choppy wiggle to the close.

Yesterday, I said: “Either this is an extremely weird coincidence, the counter-current has been achieved and the next move is down, or I have this completely wrong.” Clearly, I was wrong - and that was, in fact, a weird coincidence. As a struggling trombonist, I didn’t need one more thing to make me humble. But here we are. Or, I should say, here I am.

This is a clearly up day, at a massive level, with the hi and lo up by 518 and 171 points respectively. The span was 710 points, the highest since — well, since Monday’s 792.

The SP500 and Russell 2000 were also up, the Russell massively so. But the NASDAQ closed down. I have no idea what to make of this, nor what to expect next. All I can do is watch and report.

% Changes -

DJI30 +1.44%

SP500 +0.57%

NASDAQ -0.61%

Russell 2000 +3.98% [!!!]

DJI30 Closings -

01/04/19 - 23433

01/06/20 - 28704

12/04/20 - 30218

01/06/21 - 30829

NYSE Internals -

A/D = 2032/1160 = 1.75

A/D Vol = 4.71

New Hi/Lo = 374/6 = 62.33

Thursday, January 7. 2021

Green Arrow Up

DJI30 Index at the close —- 31,041.13 +211.73 (+0.69%)

The Index opened at 30901, up 72 points, and quickly climbed to about 30990. After a slump of about 80 points it climbed again, hitting that day’s hi of 31193, up 364, at 11:00. It slid down to 31020 at 12:30 and hovered between that level 31100 the rest of the session.

This is another clearly up day, with the hi and lo up by 171 and 585 points. The span was 296.

After yesterday and today, momentum has taken a small but significant up-tick.

In my humble opinion, this is insane.

% Changes -

DJI30 +0.69%

SP500 +1.48%

NASDAQ +2.56%

Russell 2000 +1.89%

DJI30 Closings -

01/07/19 - 23531

01/07/20 - 28582

12/07/20 - 30070

01/07/21 - 31041

NYSE Internals -

A/D = 1925/1222 = 1.58

A/D Vol = 1.89

New Hi/Lo = 375/5 = 75.00

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/tny_au_xx_usoz_4.gif)

No comments:

Post a Comment