Monday, January 18, 2020

The markets were closed in recognition of Martin Luther King Day.

Tuesday, January 19, 2021

Green Arrow Up

DJI30 Index at the close —- 30,930.52 +116.26 (+0.38%)

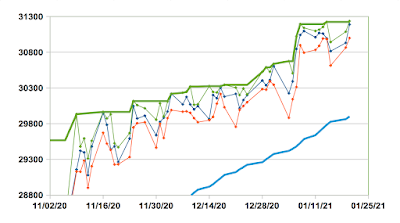

The Index opened at 30887, up 73 points, and immediately surged up another 199 to 31086 and change, the day’s hi. This was followed by a rather steep fall to 30915 in the next 20 minutes. After a bump to 30985 it dropped to the day’s lo of 30865 about an hour later. From noon on it stayed between 30925 and 30995, and slipped 65 points from that local hi in the last 2 hours.

This is a clearly up day, with the hi and lo higher by 145, and 252 points, respectively. The range was 221 points, and is surrounded by the 347 point range of 1/08. Short term momentum slid by a tiny increment.

All the excitement in this session occurred in the first half hour. The rest of the day was ho-hum. It doesn’t look like today’s gain is significant. It looks to me like a local top is forming.

% Changes -

DJI30 +.38%

SP500 +0.81%

NASDAQ +1.53%

Russell 2000 +1.49%

DJI30 Closings -

01/18/19 - 24528

01/17/20 - 29348

12/18/20 - 30179

01/15/21 - 30931

NYSE Internals -

A/D = 1979/1194 = 1.66

A/D Vol = 1.61

New Hi/Lo = 203/3 = 67.67

Wednesday, January 20, 2021

Green Arrow Up

DJI30 Index at the close —- 31,188.38 +257.86 (+0.83%)

The Index opened at 31018, up 87 points, and climbed in a sequence of higher highs and higher lows up to the day’s hi of 31236, achieved 13 minutes before the end of the session, then followed by a 48 point slide into the close.

A gain of .83% is solid, but not impressive. However, the Index achieved new all time intra-day and closing highs. Momentum measures across 5 to 34 day ranges are converging, with microscopic changes - down at the short end and up at the long end. It will be interesting to see where this leads. My guess is the Index is nearing the apex of a gain from the beginning of November.

The SP500 and NASDAQ moved up by larger percentages today, while the Russell 2000 slumped from a morning hi to end up with only a modest gain.

The market seems to approve of the incoming Biden administration, and rational people are relieved that the chaos of the trump regime has finally ended. I don’t believe that news events drive the market. The idea is that social mood drives both the markets, and which events become newsworthy. This makes sense to me.

Still, nothing moves in a straight line. There should be a correction in the next several weeks. An old stock market adage says to buy the rumor and sell the news. Something like this could be unfolding.

% Changes -

DJI30 +1.39%

SP500 +0.83%

NASDAQ +1.97%

Russell 2000 +0.44%

DJI30 Closings -

01/18/19 - 24528

01/17/20 - 29348

12/18/20 - 30179

01/15/21 - 31188

NYSE Internals -

A/D = 2006/1145 = 1.75

A/D Vol = 1.21

New Hi/Lo = 231/1 = 231.00

Thursday, January 21, 2021

Yellow Arrow sideways.

DJI30 Index at the close —- 31,176.01 -12.37 (-0.04%)

The Index opened at 31198, up 10 points. Before 10:00 it dropped about 50 points. Then it shot up to a new intra-day hi of 31272, up 84 at 10:30. After that it dropped to the day’s lo of 31121, off 67, at 12:20. It then climbed again, reaching 31245 before 3:30. It dropped to 31207, challenged the hi again, reaching 31251 just 13 minutes before the end of the session. From there it dropped 75 points into the close - 12 points under yesterday’ all time hi.

This is a clearly up day, with the hi and lo higher by 36 and 123 points, respectively. Given that, and the new intra-day hi, it feels strange to call this day’s move sideways, yet here we are. The day’s range was an exceedingly narrow 151 points. The 10 day average peaked 10 days ago at 376 and has dropped to 248 today. I wonder if this means anything? Could it be growing complacency?

Similar to yesterday, the measures of momentum that I use have converged by tiny increments. Without a significant drop in daily closings, this could take a couple weeks to complete. Of course, that assumes no major increases in the near term.

The Indexes all had roughly similar contours, with a low point near mid-day. The DJI and S&P hovered near neutral, while the NASDAQ spent the whole day in the green, while the Russell was in the red.

% Changes -

DJI30 -0.04%

SP500 +0.03%

NASDAQ +0.55%

Russell 2000 -0.89%

DJI30 Closings -

01/18/19 - 24706

01/21/20 - 29186

12/21/20 - 30216

01/21/21 - 31176

NYSE Internals -

A/D = 1226/1928 = 0.64

A/D Vol = 0.53

New Hi/Lo = 212/1 = 212.00

Friday, January 22, 2021

Red Arrow Down

DJI30 Index at the close —- 30,996.98 -179.03 (-0.57%)

The Index opened at 31142, off 34 points, and immediately dropped to 30975. Following a bounce to about 31030 after 10:00, it resumed falling, hitting the day’s lo of 30908, off 268 after 10:30. At noon it reached 31100, then meandered between that level and 31035 until the last 2 minutes of the session when it dropped 38 points into the close.

This is a clearly down day, with the hi and lo down by 131 and 212 points, respectively. The span was 233 points. A loss of 0.57% is modest, but even at the day’s hi, the index was 34 points under water.

The momentum measures, across ranges from 5 to 34 days, continue converging. The net gain for the week was 0.59%.

% Changes -

DJI30 -0.57%

SP500 -0.30%

NASDAQ +0.09%

Russell 2000 +1.28%

DJI30 Closings -

01/18/19 - 24737

01/24/20 - 28990

12/24/20 - 30200

01/25/21 - 30997

NYSE Internals -

A/D = 1690/1481 = 1.14

A/D Vol = 1.01

New Hi/Lo = 163/2 = 81.50

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/tny_au_xx_usoz_4.gif)

No comments:

Post a Comment