Tim Duy weighed in on the output gap debate - not my topic, but he presented this chart of net worth as a percentage of GDP.

Graph 1 Net worth as a Percentage of GDP

That got me thinking again about the issue of whether consumption spending is determined by income or wealth. Specifically, if consumption is determined by wealth, there should be peaks in consumption corresponding to the dot-com and housing bubbles shown on Graph 1. However, as Graph 2 shows, there were no such peaks.

Graph 2 Personal Consumption Expenditures

I've argued already that, contrary to standard economic thought, consumption is directly determined by income. (Posted at RB and at AB.) One observation was that consumption, as a fraction of income, didn't vary much over time, averaging 90.1% with a standard deviation of 2.1%.

I took a similar look at consumption and net worth, data from Fred. The next three graphs show personal consumption expenditures (PCE) as a decimal fraction of net worth (blue, left scale) along with net worth (NW) (red, right scale) over different time spans.

Graph 3A Expenditures/Net Worth and Net worth, 1959-79,

Graph 3A spans from 1959 - the beginning of the data set - to 1979. Net worth rises exponentially as the population grows. Adjusting for population growth does not change the shape of the net worth curve, so, in the aggregate, we were becoming richer during those years. Note that PCE/NW follows a generally similar, though far bumpier trajectory. As I pointed out in the prior post, the personal savings rate also increased during this period, so the average worker was able to both save and spend more.

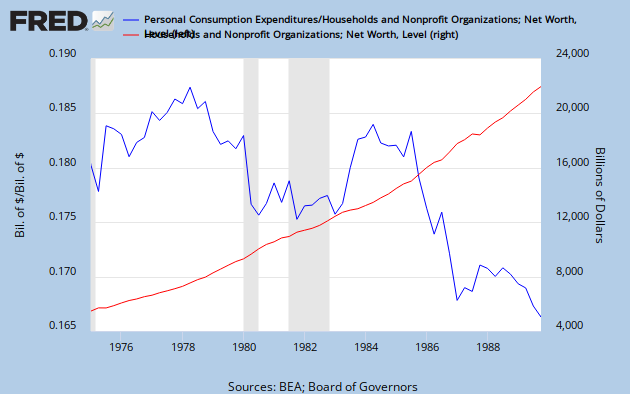

Graph 3B Expenditures/Net Worth and Net worth, 1975-90

Graph 3B spans from 1975 to 1990. Net worth continues on its exponential track. But, after about 1979, PCE/NW drops, reversing the prior trend. By 1990, PCE/NW is no greater than it was in the early 1960's. Meanwhile, the personal savings rate also dropped - to a range below that of the early 60's.

Graph 3C Expenditures/Net Worth and Net worth, 1989-2011

Graph 3C spans from 1989 through October, 2011. The exponential growth of net worth falters before and during the two most recent recessions. After about 1994, PCE/NW is a roller coaster ride. Of particular interest is the exactly contrary motion at a detail level between NW and PCE/NW, after about 1998. During the housing bubble of mid-last decade, PCE/NW hit an all time low.

What narrative makes sense of these three graphs? Here's my attempt.

Through the 60's and 70's, the standard of living was increasing, as incomes and net worth rose together. This allowed more discretionary spending, and therefore, the fraction of NW that was spent increased.

In the 80's, aggregate net worth continued to rise, but consumption spending, quite dramatically, failed to keep pace. Lane Kenworthy has repeatedly pointed out that middle class income growth has decoupled from general economic growth as the upper income percentiles have captured an increasing slice of total income. As the wealthy grew wealthier and the middle class fell behind, the fraction of NW that was spent declined - exactly the opposite of what should happen if increasing wealth determined spending. But exactly what should happen if increased wealth is diverted to the already wealthy who have less of a propensity to consume.

During the 90's, growth in median family income and GDP per capita were close to parallel (see graph at the Kenworthy link) so there was a lull in the decoupling. For most of that decade, PCE/NW was close to constant at 0.18-.19. But while spending was kept level, the personal savings rate continued to fall.

During the current century, median family income has flat-lined, while GDP/Capita has continued to increase. The decoupling has resumed and the wealth disparity has widened. During the two wealth bubbles, PCE/NW declined dramatically. When the bubbles burst and net worth declined, PCE/NW increased back into the 0.18-.19 range. Most strikingly, from about 1998 on, the two lines in graph 3C exhibit exactly contrary motion at a detail level.

Conclusions:

There was a tight relationship between Net Worth and consumption through the 60's and the 70's, when earnings growth kept up with GDP and wealth disparity was slight by current standards.

This relationship broke down during the 80's - though one could argue as early as the mid 70's - as aggregate wealth and working class income decoupled.

Most recently, the relationship between NW and PCE/NW is inverse. The big swings in NW that the bubbles provided also demonstrated that consumption spending does not depend on net worth.

As I indicated in the earlier post linked above, consumption spending does depend on disposable income, throughout the entire post war period. A simple look at readily available data casts grave doubts on the idea that wealth, and not income, determines consumption spending.

UPDATE: For the longer perspective, here is the data of Graphs 3 A-C on a single graph.

Graph 4 Expenditures/Net Worth and Net worth, 1959-2011

In part 2, we'll look at how spending and Net Worth correlate.

Cross-Posted at Angry Bear.

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/tny_au_xx_usoz_4.gif)

5 comments:

Interesting. Some datasets I've not looked at.

The picture looks quite different when you combine your graphs 3a+b+c into one long view. You definitely had to split it up to get the effect you got in Graph 3a there.

Reminds me of my What is the meaning of this? and your reply.

Thanks for the extra graph.

So at the start, personal consumption expenditures relative to net worth moves in the same general direction as net worth. But by the end, they go in opposite directions.

I have trouble conceptualizing the comparison, because net worth is in both datasets being compared (so there is a relation within the numbers, and not just within the movements that you are looking at). (I think.)

If PCE is increasing relative to net worth and net worth is increasing (as your 3a shows) then PCE is increasing faster than net worth.

If PCE is DEcreasing relative to net worth and net worth is increasing, then PCE is increasing more slowly than net worth. Your 3b.

Sound right?

Now I'm thinking that the "contrary motion" on your 3c is an effect created by the denominator (net worth) which shows substantially larger variations after the mid-1990s than before.

So I have two questions arising from your #4:

1. Why are the variations in net worth substantially larger after the mid 1990s? and

2. Why the change-of-direction? The PCE/NetWorth ratio spiked up with the 1970 and 1974 recessions (and also the near-recession of 1966-67). If this pattern continued, there would have been another up-spike in 1980. But there was a DOWN spike instead.

I agree, for this relation the pattern changes at 1980.

Other than that... Yes, I have no conclusions.

Sound right?

Yes.

Now I'm thinking that the "contrary motion" on your 3c is an effect created by the denominator (net worth) which shows substantially larger variations after the mid-1990s than before.

That's what I'm thinking.

Q's:

1) Asset bubbles and crashes.

2) I have follow up posts coming that address this. For a hint see the linked post in the text.

And I will have conclusion.

But '80-82 is an anomaly, and at this point I have no explanation.

JzB

here best replica bags click here now replica bags online her comment is here replica louis vuitton

curry shoes

jordan 1 high

curry shoes

pg shoes

goyard

hermes

jordan shoes

off white hoodie

yeezy

bape

Post a Comment