Recently, Noah Smith had a post on the subject of economic models titled Filling a hole or priming the pump? It did quite a bit to restore my lack of faith in the pseudoscience of Economics, but that is more or less beside the point. Roger Farmer, cited in the post, left a long comment that Noah hoisted up the main page. Farmer concludes:

My reading of the evidence is that consumption depends primarily on wealth rather than income. That was the lesson of work by Ando and Modigliani, Modigliani, and Friedman in the 1950s. It is for that reason that I support interventions in the asset markets that try to jump-start the economy and reduce unemployment by boosting private wealth. That, in my view, is what quantitative easing has done.

Ok - I'm taking on decades of economic research here, but my first question relates to: "My reading of the evidence is that consumption depends primarily on wealth rather than income."

First, let's remember that wealth distribution is on the order of the top 1% owning 40% of the wealth, and the bottom 80% owning 7% of the wealth. And that 7% is not evenly distributed. There are significant fractions of the population who have a) no wealth at all, or b) negative net worth. Either way, they are living hand to mouth. This suggests that 1) they have unmet needs, and 2) will spend the next available dollar trying to satisfy one of them.

So far, this is just a thought experiment. Let's take a look at how personal consumption expenditures track disposable income. Here is percent change from previous year:

Both in the grand sweep and in the year-to-year detail, the curves are pretty much in lock-step.

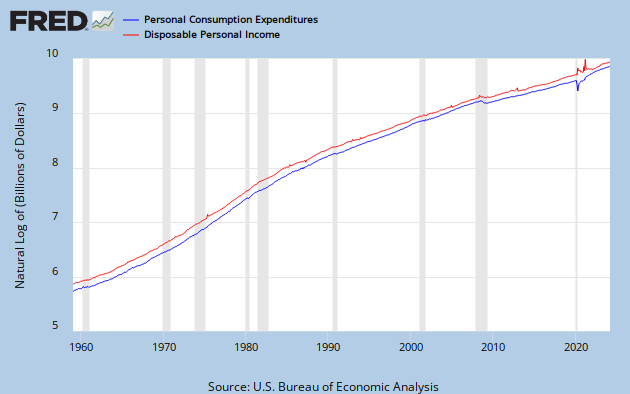

Here is the data on a Log Scale:

That's coordination about as close as you could ever hope to see in real world data.

And if wealth - or it's perception - were the determinant, wouldn't you expect some sort of a consumption bump during the housing bubble, when people felt wealthier than their incomes justified? Let's look at consumption expenditures per capita.

Here, there is a slope increase, mid last decade, but it's not great, and it's no greater than the slope of the late 90's. I suppose the tech boom must have had some people feeling wealthy then, as well. But they weren't that bottom 80%. Note that the first graph indicates the personal disposable income was up in those periods as well. In fact, they were the only up periods since about 1980.

There was also relatively low unemployment in those times, and thus more people with incomes.

Also, it just seems counter-intuitive in a world where, if real people think about money at all, it's in a personal cash flow context, not in terms of wealth aggregates. Consuption decision reasoning, to the the extent that it even occurs, is along the lines of: "If I buy this thing, can I still afford to feed my cat?"

So, here is question number 1:

Since to most people "wealth" is miniscule, non-existant, or worse, and given empirical data that closely links consumption to income, how can consumption depend "primarily on wealth rather than income?"

Now let's look at Excess Reserves of Depository Institutions.

There's 1.6 trillion QE dollars. Any left-overs have gone to leveraged speculation causing commodity inflation.

But Farmer says: "I support interventions in the asset markets that try to jump-start the economy and reduce unemployment by boosting private wealth. That, in my view, is what quantitative easing has done."

If any wealth has been boosted here, it is in the upper reaches of the already wealthy, not among the working stiffs who are highly inclined to spend the next dollar rather than hide it away in Luxombourg or the Cayman Islands.

So, here is question number 2:

How can QE money help the economy when it is either sitting idle or inflating commodity prices?

I have nothing in particular against Roger Farmer, about whom I know nothing, but I am also prompted to ask economists in general:

What in the hell is the matter with you?

So maybe my lack of faith in Economics is the point, after all.

Cross-posted at Angry Bear.

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/tny_au_xx_usoz_4.gif)

6 comments:

GREAT ending!!

I don't have answers for your Q's. I have an observation about Roger Farmer's remark. Farmer says: "I support interventions in the asset markets that try to jump-start the economy and reduce unemployment by boosting private wealth."

"... by boosting private wealth." Actually, QE has been boosting FINANCIAL wealth. Private financial wealth. If QE was boosting real wealth, atoms and sweat, lawn mowers and fish tanks and Big Macs, then I would agree with Rodger. But QE has an entirely financial focus.

Art -

Farmer left a long rebuttal at AB, which I rerebutted.

I believe the next step is peanut buttle.

And I agree completely about QE and finance. I'm utterly baffled that someone can make Farmer's assertion.

Cheers!

JzB

nba jerseys

retro jordans

coach outlet

adidas superstars

longchamp handbags

louboutin

westbrook shoes

supreme hoodie

adidas zx flux

reebok shoes

q5v57w8b38 h7y89e3i67 z7k44r1y23 s4s00r3j94 v1p76c6t64 c0r57i9s94

p9k37w7g84 g9j07f1u41 m7z07w8n10 s4f92l3t03 c5j24x5h25 h5a92s9f39

okjgr33fg8d2

golden goose outlet

golden goose outlet

golden goose outlet

golden goose outlet

golden goose outlet

golden goose outlet

supreme outlet

golden goose outlet

golden goose outlet

golden goose outlet

Post a Comment