Here, I'm reworking the ideas of this post. (Updated and edited on 1/12)

INTRODUCTION

1) Rethug Speaker of the House John Boehner says that as a nation, "we're broke"; Rethug presidential candidate Ron Paul claims America "should declare bankruptcy." I say these two are liars, and at least one of them is crazy.

2) Tyler Cowan says "we are poorer than we think we are," due to mismeasurement of value, which might be true. I believe his prescription for recovery is generally very bad, though.

3) In comments to my previous Angry Bear post, Bob McManus directed us to the writings of Michael Hudson, where we find his post Democracy and Debt. This is must reading. The relevant point here is that the increasing capture of wealth, as rents, by a creditor class impoverishes society in general, and this eventually leads to severe repression, major social upheaval, or both. I whole-heartedly agree.

4) Jon Hammond's guest post at Angry Bear shows that a more-or-less continuous decrease in real investment has occurred during the post WW II era.

In this series of posts, I intend to show that we are a wealthy nation, but that our wealth has been increasingly captured by elite creditors, who, in my opinion, are strangling the economy by 1) extracting excessive rents and 2) diverting this wealth to financial tail chasing, rather than real investment.

UPDATE (1/12): WHERE THE MONEY HASN'T GONE

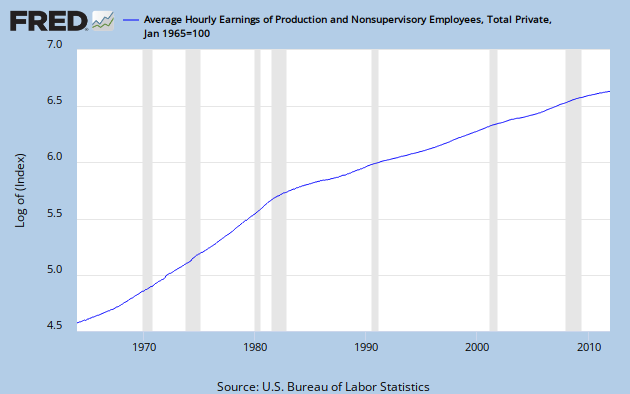

Here is a look at average hourly earnings, the typical income of a working stiff, presented on a log scale.

Like almost every time series you can imagine, including GDP, it exhibits a break near 1980. The break is always to lower growth. But, compared to most other data series, this break is especially sharp.

Hear is the same series compared to GDP, an approximate measure of the income of the nation, on a linear scale. For this graph, each is normalized to a value of 100 in Q1, 1965.

While earnings have grown less than 8 times in 47 years, GDP has grown more than 20 times.

Clearly, the money has not gone to compensation of the workers whose labor actually creates the wealth of the nation. That might explain some of the alleged envy. (end update)

CORPORATE PROFITS

As a first step in finding where the money has gone, let's consider the growth of corporate after-tax profits since about 1950. You can see it in this FRED graph. It's on a log scale, so constant growth would be a straight line. There are lots of wiggles, but I see an increasing slope over time, and it's not an optical illusion.

There are a lot of ways to parse this. One is to connect the dip bottoms with straight lines. I've done that with alternating red and blue to show the slope increasing over time. The problem is selecting which bottoms to connect. Some alternate choices are indicated in yellow. The yellow lines define times of above normal profit growth: 1970 to 1980, 1986 to 1998, and 2001 through 2007. Each of them leads to a correction, indicated by a purple line across the top of the decline.

After I did all that, it occurred to me to let Excel throw an exponential best fit line on the data set, and you can see that as well.

I see now that I could have included another yellow line from 1961 to 1967. Notice that with each yellow line, the data set advances above the exponential best fit line before a sideways correction takes it below again. After the correction is complete, profits increase again until the best fit curve is breached. Or, they did until now.

Remember that on a log scale constant growth rate is represented by a straight line, and that the growth compounds, so that the underlying increase is exponential. Sooner or later, that has to end. Nothing in the real word can go to infinity. Here we see an exponential curve on a log scale. This demonstrates an increasing growth rate. Therefore, the underlying increase is greater than exponential. If exponential growth is unsustainable, what would you say about greater than exponential growth?

In fact, the whole trend might now be falling apart, as the last blue line has a much lower slope. Also, for the first time following a correction, profits have stayed below the trend line, and the gap is increasing.

To show the extent of national income capture by corporations, here is a graph of corporate profits as a percentage of GDP. I've divided the set into two segments: 1951 to 1979, and 1980 on, and had Excel place a linear trend line on each. This division is somewhat arbitrary, but almost every economic time series you can find has a break point within a few years of 1980. Division between '79 and '80 is the least favorable to my point that Profits/GDP had no trend in the post WW II Golden Age, but have trended sharply upward during the Great Stagnation period.

Profit/GDP growth was unusually poor from 1980 through 1986. Then from late 2001 through early 2006 it exhibited the greatest growth ever. But remember the denominator effect. Nominal GDP growth increased rapidly following the '80-'82 double recession; while GDP growth in this century has been generally slow. The financial melt-down of 2008 caused a dip that was sharp and brief, but the rebound has not gone to a new high. But even now, in the midst of anemic recovery, profit/GDP is hovering in the 9 to 10% range, far above historical norms.

CONCLUSION

The corporate profit growth picture looks unsustainable, and that is troubling. What it means for the future is anybody's guess. But, what we get from it is the first partial answer to the question, "Where has all the money gone?"

Gone to profits, everyone.

1/17 Update: Cross posted today at Angry Bear.

Subscribe to:

Post Comments (Atom)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/tny_au_xx_usoz_4.gif)

7 comments:

Hey, Jazz.

Good analysis, your typical, if AB liked you before they should like you now.

I stopped in the middle of this sentence, confused:

"Something defining an exponential curve on a log scale is displaying an increasing growth rate."

By the time I got to the end of it, it was okay; but heck, I have to criticize SOMEthing...

Your ending reminds me of Peter Paul and Mary, or Pete Seeger or somebody. Nice touch.

One of the things I notice about your graph is just how bad the Reagan Recession really was. It appears that the right wing has done a great job of wiping the Reagan Recession out of the history books.

Regarding Boner/Paul, the whole "broke" / "bankrupt" thing makes no sense talking about an entity that possesses the printing press and taxing power over a major economy. That said, I don't think Paul is a liar, I think he's crazy. I mean, we're talkin' about a dude who thinks gold is money -- even though if I drop a gold coin in front of the cashier at my local Safeway, all the cashier will do is look at it in befuddlement. Which sorta renders it useless as money, since the whole point of money is that I can trade it for something to eat, not the case with that gold coin (though I could sell the gold coin to a gold dealer for *real* money). Dude ain't quite all tight in the head if he thinks that gold coin is money, yo.

Regarding Tyler Cowan: I think even PPP is not working well as a point of comparison of relative wealth. Is the average Frenchman *really* 25% less affluent than the average American? Anybody who has actually been to France would shake their head and say "Balderdash!".

Time to get back to work... hopefully others will chime in later :).

Thanks, guys.

I'll rework the exponential paragraph tomorrow. No time tonight.

I don't think Paul lies about his policy issues - though he's perfectly capable of lying on the stump like any other sleaze pol. I do think he's bat-shit crazy.

Jazz,

I caught McManus' comment and checked out Hudson too. Interesting that Art was "channeling" him in his post yesterday too. Seems to be some disagreement on what Hudson is saying? I thing the main point is that the financier/rentier class had better seriously consider extinguishing a significant amount of the private debt. (The natives are getting restless.)

You're right about Boehner and Paul. I think the reason Paul wants the US to declare bankruptcy is because it is the only way we can go back to a gold standard.(The crazy part.) Otherwise, we'd have to give a lot of our gold to the Chinese.

I almost forgot: Nice touch on the ending as Art noted. My concern is we could go from all peace, love and understanding, ala Peter, Paul and Mary, or we could end up with Bruce Cockburn's "If I Had A Rocket Launcher."

yeezy boost 350

hermes belt

yeezys

adidas tubular

lebron 16

converse outlet

golden goose outlet

air yeezy

hermes handbags

jimmy choo shoes

pg 4

kyrie 9

jordan

golden goose outlet

paul george shoes

Post a Comment