It is better to be a human being dissatisfied than a pig satisfied; better to be Socrates dissatisfied than a fool satisfied. And if the fool, or the pig, are of a different opinion, it is because they only know their own side of the question.

- John Stuart Mill

Tuesday, January 31, 2012

Quote of the Day

Sunday, January 29, 2012

The Real World of Real Work

I was reminded again of this, while reading this comment from Steve, at his own blog (following Art's link.)

Which is tangential to the topic Steve, et. al. were discussing, but keys right into something that I was thinking about. I have two degrees in Chemistry, B. S. and M.S. I worked in industry from early June of 1968 until the end of November in 2008 - a tad over 40 years. If you aggregated all the time I spent doing actual chemistry, it might total a few months; certainly it was far less than two years. If you aggregated all the time I spent doing things where my knowledge of chemistry directly informed my ability to function, it would total somewhere in the range of 15 to 20 years. Dealing with Mechanical Engineers threw this into stark relief. A typical Mechanical Engineer simply would have been incapable of doing my job. Just as I would have been incapable of doing her's - for that 30 to 50% of the time, unless I received some amount of specific training.* Also, I'll posit that specific engineering knowledge was a relevant enabler to the M.E. no more than 50% of the time.

Here is a related anecdote. Some of my musician friends are employed as computer programmers. Their education is in music. Their employer specifically seeks musicians because training them is especially easy. There is some sort of fit between the musician's mind and the tasks to be performed.

My point is that doing something other than what you were educated to do is not a misuse of talent, except in the most egregious examples - frex PhD' physicists driving cabs, Engineers delivering pizzas, Accountants digging ditches, Economists doing economics. (Sorry, couldn't resist the dig.)

Realistically, your education does not prepare you for the world of work, and most specifically, the chance of it preparing you for the job you actually get is almost vanishingly small.

__________________________________________

* Some of this is skill and training related, and some has to do with individual brain idiosyncrasies, interest level and willingness to learn. I'll bet I could learn the M.E.'s job with very little additional training. Engineering is applied math, and I'm reasonably good at that. Not so the other way around. At the briefest mention of anything remotely chemical, the M.E.'s eyes glaze over. Persist, and they will run, screaming, from the room.

My sister, after abandoning the Berkeley Phd astrophysics program, ended up [with no programming experience] programming those Visa mainframes that process billions of transactions a night — in assembler! I asked her once if she used any of her higher math from college, calculus and such. “No,” she said, “we pretty much just add and subtract. On rare occasions we’ll get really abstruse and multiply or divide.

Which is tangential to the topic Steve, et. al. were discussing, but keys right into something that I was thinking about. I have two degrees in Chemistry, B. S. and M.S. I worked in industry from early June of 1968 until the end of November in 2008 - a tad over 40 years. If you aggregated all the time I spent doing actual chemistry, it might total a few months; certainly it was far less than two years. If you aggregated all the time I spent doing things where my knowledge of chemistry directly informed my ability to function, it would total somewhere in the range of 15 to 20 years. Dealing with Mechanical Engineers threw this into stark relief. A typical Mechanical Engineer simply would have been incapable of doing my job. Just as I would have been incapable of doing her's - for that 30 to 50% of the time, unless I received some amount of specific training.* Also, I'll posit that specific engineering knowledge was a relevant enabler to the M.E. no more than 50% of the time.

Here is a related anecdote. Some of my musician friends are employed as computer programmers. Their education is in music. Their employer specifically seeks musicians because training them is especially easy. There is some sort of fit between the musician's mind and the tasks to be performed.

My point is that doing something other than what you were educated to do is not a misuse of talent, except in the most egregious examples - frex PhD' physicists driving cabs, Engineers delivering pizzas, Accountants digging ditches, Economists doing economics. (Sorry, couldn't resist the dig.)

Realistically, your education does not prepare you for the world of work, and most specifically, the chance of it preparing you for the job you actually get is almost vanishingly small.

__________________________________________

* Some of this is skill and training related, and some has to do with individual brain idiosyncrasies, interest level and willingness to learn. I'll bet I could learn the M.E.'s job with very little additional training. Engineering is applied math, and I'm reasonably good at that. Not so the other way around. At the briefest mention of anything remotely chemical, the M.E.'s eyes glaze over. Persist, and they will run, screaming, from the room.

Labels:

education,

employment,

life,

music,

non-meshing gears,

random thought

Saturday, January 28, 2012

Right to the Moon

My Lovely Wife suggested that I make a blog reference to the Newster's moon base idea, incorporating Ralph Cramden's classic threatening, fist-in-her-face line: "One of these day's Alice . . . . Pow - right to the moon!"

Well, that's how I remember it, anyway.

I am nothing, if not obedient. My intent was to find (rather cop-outishly, I'll admit) a brief YouTube clip featuring that line. But, alas, no. If you can do better, please let me know.

Then, she went and found this page. Hoo-boy. Pwned by my spouse.

At the link above, Groobiecat did all the heavy lifting, and put up a damned good post, including a fun Photoshopped pic. A must-read, I'd say.

Now, by way of fair and balanced (choke!) reporting, I'll also direct you to the ever independent-thinking Tux's defense of the out-of-this-world Newtonian moon-base idea.

My answer to Tux's "What's the matter with a Moon base?" question includes these points:

- the cost, which in a world filled with austerians, is an automatic no-go;

- the lack of a real need to do anything specifically lunar;

- the unsustainability of a moon base;

- Newt is a lying political opportunist, playing to the Florida space industry base. His plan isn't a realistic proposal. It is a cynical, pandering ploy for votes;

- did Newt really float the idea of the Moon becoming a 51st State, or was that commentator hyperbole?

Tux talks about employing all sorts of highly skilled professionals in this potential program, and you can't simply gainsay that. However, on balance, the negatives overpower, I think. Besides - isn't there some sort of a project, right here on earth, that would employ all those same skilled professionals, while doing something real?

Space exploration has a very high cool-geek factor. But, deep in my heart, I believe the time for manned space exploration has come and gone. Actually, several decades ago.

There are pressing needs here at home, and excess brain-power available to devote to solving them.

Shouldn't there be some realistic way way to bring them together?

On the other hand, though - and more fundamentally - we don't have structural unemployment. If we did, this kind of specific skill-matching program would be right on the mark. What we do have is general unemployment. The answer to that is to correct the aggregate demand shortfall.

I wonder what Keynes would say?

Well, that's how I remember it, anyway.

I am nothing, if not obedient. My intent was to find (rather cop-outishly, I'll admit) a brief YouTube clip featuring that line. But, alas, no. If you can do better, please let me know.

Then, she went and found this page. Hoo-boy. Pwned by my spouse.

At the link above, Groobiecat did all the heavy lifting, and put up a damned good post, including a fun Photoshopped pic. A must-read, I'd say.

Now, by way of fair and balanced (choke!) reporting, I'll also direct you to the ever independent-thinking Tux's defense of the out-of-this-world Newtonian moon-base idea.

My answer to Tux's "What's the matter with a Moon base?" question includes these points:

- the cost, which in a world filled with austerians, is an automatic no-go;

- the lack of a real need to do anything specifically lunar;

- the unsustainability of a moon base;

- Newt is a lying political opportunist, playing to the Florida space industry base. His plan isn't a realistic proposal. It is a cynical, pandering ploy for votes;

- did Newt really float the idea of the Moon becoming a 51st State, or was that commentator hyperbole?

Tux talks about employing all sorts of highly skilled professionals in this potential program, and you can't simply gainsay that. However, on balance, the negatives overpower, I think. Besides - isn't there some sort of a project, right here on earth, that would employ all those same skilled professionals, while doing something real?

Space exploration has a very high cool-geek factor. But, deep in my heart, I believe the time for manned space exploration has come and gone. Actually, several decades ago.

There are pressing needs here at home, and excess brain-power available to devote to solving them.

Shouldn't there be some realistic way way to bring them together?

On the other hand, though - and more fundamentally - we don't have structural unemployment. If we did, this kind of specific skill-matching program would be right on the mark. What we do have is general unemployment. The answer to that is to correct the aggregate demand shortfall.

I wonder what Keynes would say?

Labels:

criticism,

current events,

economics,

employment,

science

Friday, January 27, 2012

Is This Where The Newt Slithers Back Under A Rock?

I didn't watch the Rethug debate last night. there is only so much idiocy I can take without having my head explode. But, from what I've gathered, Newt more or less imploded. Maybe this was predictable. The man is wildly erratic.

Krugman whimsically posts this.

You needn't click through, here is the vid he embedded, saying only: "I gather from those who watched the debate that this is pretty much over."

My take as a jazz guy has to do with the music, rather than the message.

I find it quite interesting that Diana Krall's performance is so informed by this Sammy Nestico arrangement. I've played it many times, and it comes close to being my absolute most favorite arrangement of anything.

UPDATE: In comments, nanute directs us to this, earning a big H/T.

Krugman whimsically posts this.

You needn't click through, here is the vid he embedded, saying only: "I gather from those who watched the debate that this is pretty much over."

My take as a jazz guy has to do with the music, rather than the message.

I find it quite interesting that Diana Krall's performance is so informed by this Sammy Nestico arrangement. I've played it many times, and it comes close to being my absolute most favorite arrangement of anything.

UPDATE: In comments, nanute directs us to this, earning a big H/T.

Labels:

conservative shark jumping,

current events,

music

Wealth vs Income

Usually

my articles present facts and data and try to drive down to a

conclusion. This time, I'm going to drive down to a couple of questions.

Recently, Noah Smith had a post on the subject of economic models titled Filling a hole or priming the pump? It did quite a bit to restore my lack of faith in the pseudoscience of Economics, but that is more or less beside the point. Roger Farmer, cited in the post, left a long comment that Noah hoisted up the main page. Farmer concludes:

Ok - I'm taking on decades of economic research here, but my first question relates to: "My reading of the evidence is that consumption depends primarily on wealth rather than income."

First, let's remember that wealth distribution is on the order of the top 1% owning 40% of the wealth, and the bottom 80% owning 7% of the wealth. And that 7% is not evenly distributed. There are significant fractions of the population who have a) no wealth at all, or b) negative net worth. Either way, they are living hand to mouth. This suggests that 1) they have unmet needs, and 2) will spend the next available dollar trying to satisfy one of them.

Recently, Noah Smith had a post on the subject of economic models titled Filling a hole or priming the pump? It did quite a bit to restore my lack of faith in the pseudoscience of Economics, but that is more or less beside the point. Roger Farmer, cited in the post, left a long comment that Noah hoisted up the main page. Farmer concludes:

My reading of the evidence is that consumption depends primarily on wealth rather than income. That was the lesson of work by Ando and Modigliani, Modigliani, and Friedman in the 1950s. It is for that reason that I support interventions in the asset markets that try to jump-start the economy and reduce unemployment by boosting private wealth. That, in my view, is what quantitative easing has done.

Ok - I'm taking on decades of economic research here, but my first question relates to: "My reading of the evidence is that consumption depends primarily on wealth rather than income."

First, let's remember that wealth distribution is on the order of the top 1% owning 40% of the wealth, and the bottom 80% owning 7% of the wealth. And that 7% is not evenly distributed. There are significant fractions of the population who have a) no wealth at all, or b) negative net worth. Either way, they are living hand to mouth. This suggests that 1) they have unmet needs, and 2) will spend the next available dollar trying to satisfy one of them.

Labels:

Angry Bear,

criticism,

economics,

income and wealth

Wednesday, January 25, 2012

Poor People Have Shitty Lobbyists

I think that is what Stewart says at the end of the clip.

Meanwhile, here are some good insights into the mind of Mitt.

Meanwhile, here are some good insights into the mind of Mitt.

Despicable!

Frankly, I was appalled by the Gingrich response to John King's open marriage question last week at the start of the 75488929th Rethug "debate." It got worse, but we'll get to that later.

Newt did what conservatives always do when they have no answer. He changed the subject.

He did what Rethugs always do when they should rationally be considered defenseless. He flipped the enormous negative into an enormous positive. Here, I'll just turn it over to John Stewart, who is an actual professional at this sort of thing.

It's later. Here's the getting worse part. Newt was trailing significantly in S.C. until he unleashed his inner bulldog on the utterly hapless John King. Whether this was a planned outcome or King was simply totally unprepared is something I'll let the conspiracy theorists sort out. But it's clear that at that moment Newt won the flinty hearts and defective minds of the the sociopathic mob known as the South Carolina Rethug electorate.

As exhibit B, I'll point out that when revelations of Herman Cain's sexual harassment surfaced, his campaign received a surge of donations.

This is sick, appalling, and - yes - despicable.

This is what conservatism has degenerated into.

This is the modern Republican party.

Newt did what conservatives always do when they have no answer. He changed the subject.

He did what Rethugs always do when they should rationally be considered defenseless. He flipped the enormous negative into an enormous positive. Here, I'll just turn it over to John Stewart, who is an actual professional at this sort of thing.

It's later. Here's the getting worse part. Newt was trailing significantly in S.C. until he unleashed his inner bulldog on the utterly hapless John King. Whether this was a planned outcome or King was simply totally unprepared is something I'll let the conspiracy theorists sort out. But it's clear that at that moment Newt won the flinty hearts and defective minds of the the sociopathic mob known as the South Carolina Rethug electorate.

As exhibit B, I'll point out that when revelations of Herman Cain's sexual harassment surfaced, his campaign received a surge of donations.

This is sick, appalling, and - yes - despicable.

This is what conservatism has degenerated into.

This is the modern Republican party.

Tuesday, January 24, 2012

Stockman on Crony Capitalism

Holy socialization of losses, Batman. I had no idea I was channeling David Stockman when I wrote this post. Thing is, Stockman is an unreformed free-market Reaganite supply-sider. But not quite the free market guy I imagined him to be, as it turns out - a least as it regards Glass-Steagall and derivatives regulation. He's all about a certain kind of creative destruction, though, that I find myself applauding.

Notable quote: "If it's to big to fail, it's too big to exist."

I listened to this with an ear toward finding something I would disagree with. The most I can come up with is his cry for "free market capitalism," past the the 30 minute mark. Amazingly, at the end, he even channels Bernie Sanders. I'll never be a Stockman fan, though.

What's striking is that when someone as far to the right as he is lines up on the same side of an issue as I do, it shows just how far out of bounds things have gone.

David Stockman on Crony Capitalism from BillMoyers.com on Vimeo.

Huge H/T to Daniel Becker in comments at AB.

Where Has All The Money Gone, Part II - Finance Sector

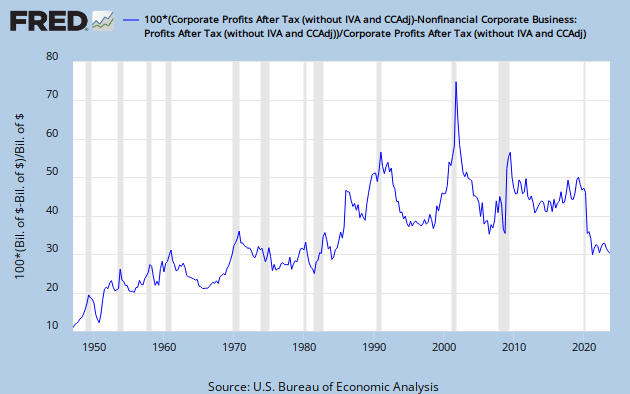

In Part I we saw that labor's earnings have lagged far behind GDP growth. (More on earnings stagnation here)

Meanwhile, corporate profits have grown at a rate that, until recently,

increased over time, and they are now at a historically high fraction

of GDP.

Here is a specific look at the Finance Sector. The graph shows finance sector profits as a percentage of total corporate profits - all after tax.

That's a pretty impressive sweep up over time. I threw some best fit curves through the whole data set, and also though the peaks and valleys. Curves through the extremes are exponential.

Along with the increased percentage we get a dramatic increase in the data spread.

When lines jump around a lot, you can sometimes get clarification by looking at a long average. I tried that here with a 13 year average.

A long average filters out the hash, and reveals the underlying trend. Or, I should say, trends, since there are two, with a sharp break at the beginning of 1986. A best-fit least squares trend line on the data through '85 is a near-perfect match to the average line, which barely even wiggles. We see a bit more action in the post-85 segment, but the new trend is still very clear, indeed. The earlier trend line in green is now the lower channel support line.

The finance sector has captured an increasing fraction of corporate profits, which have been growing at an increasing rate since WWII. And the growth rates are greatest when the economy is doing the worst. Take another look at the first graph. The correlation of finance sector profit peaks with recessions is close to perfect. Peaks are in Q2-1949, Q3-1952, Q4-1953, Q1-1958, Q1-1961, Q4-1970, Q1-1986, Q1-1991, Q4-2001. The peak in 1986 is the only one that does not correspond to a recession.

The finance sector provides a vital function. It is there to facilitate and enable the wheels of industry to turn. But policy matters. What has happened in the age of deregulation and lax taxation is that the finance sector has come to dominate the economy. This is madness. And here is your Great Stagnation, folks.

Beyond the point of supplying necessary financing for businesses and mortgages, financial manoeuvrings - speculation in particular, and most especially so with sophisticated derivatives that nobody knows how to rationally evaluate - become rent seeking. This is a massive misallocation of resources, diverting capital from real investment into totally non-value-added financial tail chasing.

And I'm not the only who thinks so. Here, Paul Krugman calling the whole operation A Giant Scam, quotes Andrew Haldane, Executive Director, Financial Stability, Bank of England:

Haldane's article was reposted at Naked Capitalism. What he is getting at is the derivatives market, the unregulated darling of the World of High Finance. Estimates vary, since there is no good way to get a handle on it, but the highly leveraged derivatives market has a notional value somewhere between 10 and 25 times the aggregate value of global GDP. In the wake of Phil Graham's undoing of Glass-Steagal came a sea change in the way the Finance Sector does business, and along with this came a shift from risk management to risk-making. As Haldane put it: "If risk-making were a value-adding activity, Russian roulette players would contribute disproportionately to global welfare."

Since none of this activity does anything to create real wealth, it is nothing but rent-seeking. That is bad, in and of itself. Worse, still, in Krugman's words: "Wall Street and the City were con artists extracting huge rents from an unwary public (and eventually dumping much of the cost, when things went bad, on taxpayers)." What is perhaps worst of all is that the money locked up in these ventures is diverted from real investment.

So, here is the picture. While the average earnings of working stiffs has been stagnant, at best, corporate profits have grown at an increasing rate. Further, the percentage of those profits going to the Finance sector has also grown at an increasing rate. Total profit growth is above exponential, and Finance Sector profit growth is super-exponential.

To summarize:

1) Over the last 30 years banking has devolved from a necessary financial function involved in the allocation of resources and management of risk to essentially non-value-added rent-seeking activities implemented through high risk practices.

2) When the whole house of cards came tumbling down, the losses were socialized, while the criminals who perpetrated the underlying fraud walked off not only scot-free, but with huge bonuses.

There might be some way to justify this if it were leading to greater GDP growth or a rising tide that lifted all the boats. But the opposite has happened. GDP growth has been in decline for decades, and the tsunami of profits floating the yachts in the Finance Sector has swamped all the dinghies.

Cross Posted at Angry Bear.

Here is a specific look at the Finance Sector. The graph shows finance sector profits as a percentage of total corporate profits - all after tax.

That's a pretty impressive sweep up over time. I threw some best fit curves through the whole data set, and also though the peaks and valleys. Curves through the extremes are exponential.

Along with the increased percentage we get a dramatic increase in the data spread.

When lines jump around a lot, you can sometimes get clarification by looking at a long average. I tried that here with a 13 year average.

A long average filters out the hash, and reveals the underlying trend. Or, I should say, trends, since there are two, with a sharp break at the beginning of 1986. A best-fit least squares trend line on the data through '85 is a near-perfect match to the average line, which barely even wiggles. We see a bit more action in the post-85 segment, but the new trend is still very clear, indeed. The earlier trend line in green is now the lower channel support line.

The finance sector has captured an increasing fraction of corporate profits, which have been growing at an increasing rate since WWII. And the growth rates are greatest when the economy is doing the worst. Take another look at the first graph. The correlation of finance sector profit peaks with recessions is close to perfect. Peaks are in Q2-1949, Q3-1952, Q4-1953, Q1-1958, Q1-1961, Q4-1970, Q1-1986, Q1-1991, Q4-2001. The peak in 1986 is the only one that does not correspond to a recession.

The finance sector provides a vital function. It is there to facilitate and enable the wheels of industry to turn. But policy matters. What has happened in the age of deregulation and lax taxation is that the finance sector has come to dominate the economy. This is madness. And here is your Great Stagnation, folks.

Beyond the point of supplying necessary financing for businesses and mortgages, financial manoeuvrings - speculation in particular, and most especially so with sophisticated derivatives that nobody knows how to rationally evaluate - become rent seeking. This is a massive misallocation of resources, diverting capital from real investment into totally non-value-added financial tail chasing.

And I'm not the only who thinks so. Here, Paul Krugman calling the whole operation A Giant Scam, quotes Andrew Haldane, Executive Director, Financial Stability, Bank of England:

In fact, high pre-crisis returns to banking had a much more mundane explanation. They reflected simply increased risk-taking across the sector. This was not an outward shift in the portfolio possibility set of finance. Instead, it was a traverse up the high-wire of risk and return. This hire-wire act involved, on the asset side, rapid credit expansion, often through the development of poorly understood financial instruments. On the liability side, this ballooning balance sheet was financed using risky leverage, often at short maturities.

In what sense is increased risk-taking by banks a value-added service for the economy at large? In short, it is not.

Haldane's article was reposted at Naked Capitalism. What he is getting at is the derivatives market, the unregulated darling of the World of High Finance. Estimates vary, since there is no good way to get a handle on it, but the highly leveraged derivatives market has a notional value somewhere between 10 and 25 times the aggregate value of global GDP. In the wake of Phil Graham's undoing of Glass-Steagal came a sea change in the way the Finance Sector does business, and along with this came a shift from risk management to risk-making. As Haldane put it: "If risk-making were a value-adding activity, Russian roulette players would contribute disproportionately to global welfare."

Since none of this activity does anything to create real wealth, it is nothing but rent-seeking. That is bad, in and of itself. Worse, still, in Krugman's words: "Wall Street and the City were con artists extracting huge rents from an unwary public (and eventually dumping much of the cost, when things went bad, on taxpayers)." What is perhaps worst of all is that the money locked up in these ventures is diverted from real investment.

So, here is the picture. While the average earnings of working stiffs has been stagnant, at best, corporate profits have grown at an increasing rate. Further, the percentage of those profits going to the Finance sector has also grown at an increasing rate. Total profit growth is above exponential, and Finance Sector profit growth is super-exponential.

To summarize:

1) Over the last 30 years banking has devolved from a necessary financial function involved in the allocation of resources and management of risk to essentially non-value-added rent-seeking activities implemented through high risk practices.

2) When the whole house of cards came tumbling down, the losses were socialized, while the criminals who perpetrated the underlying fraud walked off not only scot-free, but with huge bonuses.

There might be some way to justify this if it were leading to greater GDP growth or a rising tide that lifted all the boats. But the opposite has happened. GDP growth has been in decline for decades, and the tsunami of profits floating the yachts in the Finance Sector has swamped all the dinghies.

Cross Posted at Angry Bear.

Monday, January 23, 2012

Florida

Here is a Romney attack ad on Newt.

Sadly, one of these rats will be the Rethug nominee for president later this year.

Sadly, one of these rats will be the Rethug nominee for president later this year.

Sunday, January 22, 2012

NFL Postseason

The championship games have resulted in the worst possible outcome.

Of course, so did last week's playoff games.

I don't have much feeling one way or the other for the Giants. I do have some faint positives for the 49ers. Don't ask me why. But I loath the Patriots, and I especially loath Tom Brady. It is particularly disappointing to see them win when he had a pretty bad day. I did so much want him to be the goat.

Whether I will even watch the Super Bowl is at this point an open question.

As an aside, it seems that neither Joe Flacco nor Alex Smith is above the mediocre level as a QB, despite Smith's heroics last week.

Of course, so did last week's playoff games.

I don't have much feeling one way or the other for the Giants. I do have some faint positives for the 49ers. Don't ask me why. But I loath the Patriots, and I especially loath Tom Brady. It is particularly disappointing to see them win when he had a pretty bad day. I did so much want him to be the goat.

Whether I will even watch the Super Bowl is at this point an open question.

As an aside, it seems that neither Joe Flacco nor Alex Smith is above the mediocre level as a QB, despite Smith's heroics last week.

Saturday, January 21, 2012

What It Means To Be Conservative

Here are some characteristics of American conservatives, based on how a State votes.

Typically more overweight.

More likely to be receiving food stamps.

Less likely to have graduated from high school.

Less likely to have the labor force represented by a union.

More likely to receive federal aid in excess of contributions.

More likely to be violent.

Have higher incarceration rates.

Have far more executions.

Are are much more deeply religious.

This is not hyperbole. Karlo has the facts and the graphs to back up what he just said. Go check it out.

Typically more overweight.

More likely to be receiving food stamps.

Less likely to have graduated from high school.

Less likely to have the labor force represented by a union.

More likely to receive federal aid in excess of contributions.

More likely to be violent.

Have higher incarceration rates.

Have far more executions.

Are are much more deeply religious.

In short, the word "conservative" seems to be an apt label for a syndrome--a long list of psychological and cultural maladies--that wreak havoc on both individuals and communities

This is not hyperbole. Karlo has the facts and the graphs to back up what he just said. Go check it out.

Republicans, All Wrong, All the Time, Pt 32 - Obama Has No Jobs Plan

This is one of the many lies we get from the damned lying liars in the clown car passing for the slate of Rethug presidential candidates.

Here is the truth.

Here's Andrew Sullivan:

Link to Part 31.

Here is the truth.

On the economy, the facts are these. When Obama took office, the United States was losing around 750,000 jobs a month. The last quarter of 2008 saw an annualized drop in growth approaching 9 percent. This was the most serious downturn since the 1930s, there was a real chance of a systemic collapse of the entire global financial system, and unemployment and debt—lagging indicators—were about to soar even further. No fair person can blame Obama for the wreckage of the next 12 months, as the financial crisis cut a swath through employment. Economies take time to shift course.

But Obama did several things at once: he continued the bank bailout begun by George W. Bush, he initiated a bailout of the auto industry, and he worked to pass a huge stimulus package of $787 billion.

All these decisions deserve scrutiny. And in retrospect, they were far more successful than anyone has yet fully given Obama the credit for. The job collapse bottomed out at the beginning of 2010, as the stimulus took effect. Since then, the U.S. has added 2.4 million jobs. That’s not enough, but it’s far better than what Romney would have you believe, and more than the net jobs created under the entire Bush administration. In 2011 alone, 1.9 million private-sector jobs were created, while a net 280,000 government jobs were lost. Overall government employment has declined 2.6 percent over the past 3 years. (That compares with a drop of 2.2 percent during the early years of the Reagan administration.) To listen to current Republican rhetoric about Obama’s big-government socialist ways, you would imagine that the reverse was true. It isn’t.

Link to Part 31.

Thursday, January 19, 2012

Jon Snow, Lord Commander of the Night's Watch

Reduced to a haiku.

More on Jon Snow can be found here.

The ice wall stands hard,

Stark against the cold terror:

Winter is coming.

More on Jon Snow can be found here.

Shorter Leda and the Swan

Reduced to a Haiku.

Gods and mortals, eked

From a woman's loins; Great God:

He flipped her the bird.

From a woman's loins; Great God:

He flipped her the bird.

Tuesday, January 17, 2012

Huntsman Endorses Romney

John Huntsman is throwing in the towel, after consistently polling in the low single digits. (Eschewing an obvious joke here.)

Now he endorses Mitt the Ripper. Propitious flip-flop? You be the judge.

Now he endorses Mitt the Ripper. Propitious flip-flop? You be the judge.

Monday, January 16, 2012

Shorter Sonnet 12

Reduced to a Haiku

All ages, withers,

Dies. You too. Now - you look fine!

Let's make a baby.

Original can be found here.

All ages, withers,

Dies. You too. Now - you look fine!

Let's make a baby.

Original can be found here.

Ayn Rand Truthiness

To see someone do something I wish I woulda, and to see it done better than I evah coulda is a chastening experience.

Ayn Rand Truthiness, Pt 1.

Ayn Rand Truthiness, Pt 2.

The 1959 Mike Wallace interview.

And, to save you a click-through, here is what started it.

And this is how it works.

H/T to RJS in coments at AB

Ayn Rand Truthiness, Pt 1.

Ayn Rand Truthiness, Pt 2.

The 1959 Mike Wallace interview.

And, to save you a click-through, here is what started it.

And this is how it works.

H/T to RJS in coments at AB

GDP Revisions

This is just a short post to illustrate the magnitude of GDP revisions. I downloaded quarterly GDP data from BEA in June 2011. I went back to BEA this morning to update the file. Forgetting about GDP revisions, I thought I'd be adding 2 or three more quarters of data, but discovered that all the numbers since Q2 2003 had been revised. Prior values are unchanged. Plotted below is the difference between the June, 2011 numbers and what I found this morning.

The depth of the trough in Q3 2009 was $194 Billion worse than we thought just a few months ago. I was surprised to see the revisions go back a full 9 years.

Tyler Cowan got one thing right. We are poorer than we think we are.

Cross Posted at Angry Bear

The depth of the trough in Q3 2009 was $194 Billion worse than we thought just a few months ago. I was surprised to see the revisions go back a full 9 years.

Tyler Cowan got one thing right. We are poorer than we think we are.

Cross Posted at Angry Bear

Saturday, January 14, 2012

What A Lannister Always Pays

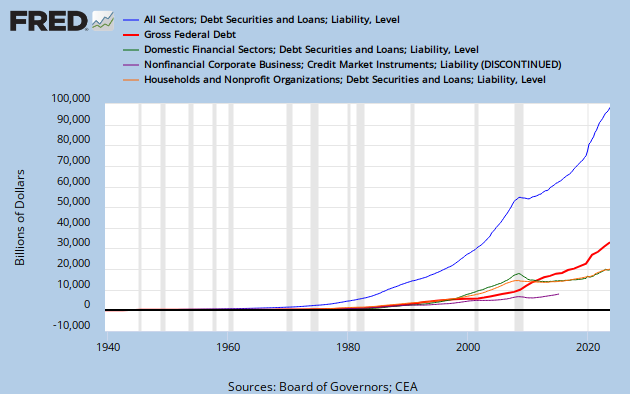

Here is a look at various types of debt.

Linear scale.

Log scale.

All we ever hear about is the size of the Federal Debt.

It is dwarfed by total credit market debt.

It is only slightly larger than non-financial corporate business debt.

It is no larger, and in recent years has typically been smaller than

- Household credit market debt

- Domestic financial sector debt.

Nobody (well, almost) ever talks about any debt other than federal.

But it is the least of our problems.

___________________________________

In case anyone doesn't get the reference.

Linear scale.

Log scale.

All we ever hear about is the size of the Federal Debt.

It is dwarfed by total credit market debt.

It is only slightly larger than non-financial corporate business debt.

It is no larger, and in recent years has typically been smaller than

- Household credit market debt

- Domestic financial sector debt.

Nobody (well, almost) ever talks about any debt other than federal.

But it is the least of our problems.

___________________________________

In case anyone doesn't get the reference.

Wednesday, January 11, 2012

When Mitt Romney Came to Town

Here is the full 28 minute video that Newt's organization put together to tell the world about Mitt Romney. Is it slanted? Probably. I won't suggest that Newt has anything resembling scruples, even in a vague way. But is it swift-boating? I have my doubts on that account. If the record is real, then it is just painful truth. Truth is, this story is told with a lot of pain. And, really -- isn't this what vulture capitalists do?

The amazing thing is that it is coming from another Rethug - specifically, the guy who only days ago was whining about the attack ads on him. As if he actually had a soul. Wow - we are really screwed.

H/T to the LW

The amazing thing is that it is coming from another Rethug - specifically, the guy who only days ago was whining about the attack ads on him. As if he actually had a soul. Wow - we are really screwed.

H/T to the LW

Where Has All The Money Gone, Pt I, Corporate Profits Redux

Here, I'm reworking the ideas of this post. (Updated and edited on 1/12)

INTRODUCTION

1) Rethug Speaker of the House John Boehner says that as a nation, "we're broke"; Rethug presidential candidate Ron Paul claims America "should declare bankruptcy." I say these two are liars, and at least one of them is crazy.

2) Tyler Cowan says "we are poorer than we think we are," due to mismeasurement of value, which might be true. I believe his prescription for recovery is generally very bad, though.

3) In comments to my previous Angry Bear post, Bob McManus directed us to the writings of Michael Hudson, where we find his post Democracy and Debt. This is must reading. The relevant point here is that the increasing capture of wealth, as rents, by a creditor class impoverishes society in general, and this eventually leads to severe repression, major social upheaval, or both. I whole-heartedly agree.

4) Jon Hammond's guest post at Angry Bear shows that a more-or-less continuous decrease in real investment has occurred during the post WW II era.

In this series of posts, I intend to show that we are a wealthy nation, but that our wealth has been increasingly captured by elite creditors, who, in my opinion, are strangling the economy by 1) extracting excessive rents and 2) diverting this wealth to financial tail chasing, rather than real investment.

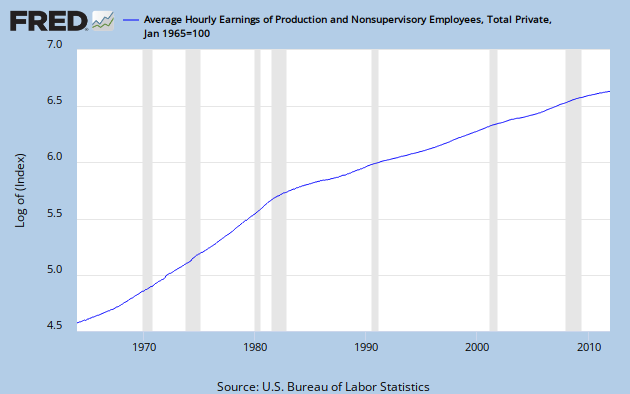

UPDATE (1/12): WHERE THE MONEY HASN'T GONE

Here is a look at average hourly earnings, the typical income of a working stiff, presented on a log scale.

Like almost every time series you can imagine, including GDP, it exhibits a break near 1980. The break is always to lower growth. But, compared to most other data series, this break is especially sharp.

Hear is the same series compared to GDP, an approximate measure of the income of the nation, on a linear scale. For this graph, each is normalized to a value of 100 in Q1, 1965.

While earnings have grown less than 8 times in 47 years, GDP has grown more than 20 times.

Clearly, the money has not gone to compensation of the workers whose labor actually creates the wealth of the nation. That might explain some of the alleged envy. (end update)

CORPORATE PROFITS

As a first step in finding where the money has gone, let's consider the growth of corporate after-tax profits since about 1950. You can see it in this FRED graph. It's on a log scale, so constant growth would be a straight line. There are lots of wiggles, but I see an increasing slope over time, and it's not an optical illusion.

There are a lot of ways to parse this. One is to connect the dip bottoms with straight lines. I've done that with alternating red and blue to show the slope increasing over time. The problem is selecting which bottoms to connect. Some alternate choices are indicated in yellow. The yellow lines define times of above normal profit growth: 1970 to 1980, 1986 to 1998, and 2001 through 2007. Each of them leads to a correction, indicated by a purple line across the top of the decline.

After I did all that, it occurred to me to let Excel throw an exponential best fit line on the data set, and you can see that as well.

I see now that I could have included another yellow line from 1961 to 1967. Notice that with each yellow line, the data set advances above the exponential best fit line before a sideways correction takes it below again. After the correction is complete, profits increase again until the best fit curve is breached. Or, they did until now.

Remember that on a log scale constant growth rate is represented by a straight line, and that the growth compounds, so that the underlying increase is exponential. Sooner or later, that has to end. Nothing in the real word can go to infinity. Here we see an exponential curve on a log scale. This demonstrates an increasing growth rate. Therefore, the underlying increase is greater than exponential. If exponential growth is unsustainable, what would you say about greater than exponential growth?

In fact, the whole trend might now be falling apart, as the last blue line has a much lower slope. Also, for the first time following a correction, profits have stayed below the trend line, and the gap is increasing.

To show the extent of national income capture by corporations, here is a graph of corporate profits as a percentage of GDP. I've divided the set into two segments: 1951 to 1979, and 1980 on, and had Excel place a linear trend line on each. This division is somewhat arbitrary, but almost every economic time series you can find has a break point within a few years of 1980. Division between '79 and '80 is the least favorable to my point that Profits/GDP had no trend in the post WW II Golden Age, but have trended sharply upward during the Great Stagnation period.

Profit/GDP growth was unusually poor from 1980 through 1986. Then from late 2001 through early 2006 it exhibited the greatest growth ever. But remember the denominator effect. Nominal GDP growth increased rapidly following the '80-'82 double recession; while GDP growth in this century has been generally slow. The financial melt-down of 2008 caused a dip that was sharp and brief, but the rebound has not gone to a new high. But even now, in the midst of anemic recovery, profit/GDP is hovering in the 9 to 10% range, far above historical norms.

CONCLUSION

The corporate profit growth picture looks unsustainable, and that is troubling. What it means for the future is anybody's guess. But, what we get from it is the first partial answer to the question, "Where has all the money gone?"

Gone to profits, everyone.

1/17 Update: Cross posted today at Angry Bear.

INTRODUCTION

1) Rethug Speaker of the House John Boehner says that as a nation, "we're broke"; Rethug presidential candidate Ron Paul claims America "should declare bankruptcy." I say these two are liars, and at least one of them is crazy.

2) Tyler Cowan says "we are poorer than we think we are," due to mismeasurement of value, which might be true. I believe his prescription for recovery is generally very bad, though.

3) In comments to my previous Angry Bear post, Bob McManus directed us to the writings of Michael Hudson, where we find his post Democracy and Debt. This is must reading. The relevant point here is that the increasing capture of wealth, as rents, by a creditor class impoverishes society in general, and this eventually leads to severe repression, major social upheaval, or both. I whole-heartedly agree.

4) Jon Hammond's guest post at Angry Bear shows that a more-or-less continuous decrease in real investment has occurred during the post WW II era.

In this series of posts, I intend to show that we are a wealthy nation, but that our wealth has been increasingly captured by elite creditors, who, in my opinion, are strangling the economy by 1) extracting excessive rents and 2) diverting this wealth to financial tail chasing, rather than real investment.

UPDATE (1/12): WHERE THE MONEY HASN'T GONE

Here is a look at average hourly earnings, the typical income of a working stiff, presented on a log scale.

Like almost every time series you can imagine, including GDP, it exhibits a break near 1980. The break is always to lower growth. But, compared to most other data series, this break is especially sharp.

Hear is the same series compared to GDP, an approximate measure of the income of the nation, on a linear scale. For this graph, each is normalized to a value of 100 in Q1, 1965.

While earnings have grown less than 8 times in 47 years, GDP has grown more than 20 times.

Clearly, the money has not gone to compensation of the workers whose labor actually creates the wealth of the nation. That might explain some of the alleged envy. (end update)

CORPORATE PROFITS

As a first step in finding where the money has gone, let's consider the growth of corporate after-tax profits since about 1950. You can see it in this FRED graph. It's on a log scale, so constant growth would be a straight line. There are lots of wiggles, but I see an increasing slope over time, and it's not an optical illusion.

There are a lot of ways to parse this. One is to connect the dip bottoms with straight lines. I've done that with alternating red and blue to show the slope increasing over time. The problem is selecting which bottoms to connect. Some alternate choices are indicated in yellow. The yellow lines define times of above normal profit growth: 1970 to 1980, 1986 to 1998, and 2001 through 2007. Each of them leads to a correction, indicated by a purple line across the top of the decline.

After I did all that, it occurred to me to let Excel throw an exponential best fit line on the data set, and you can see that as well.

I see now that I could have included another yellow line from 1961 to 1967. Notice that with each yellow line, the data set advances above the exponential best fit line before a sideways correction takes it below again. After the correction is complete, profits increase again until the best fit curve is breached. Or, they did until now.

Remember that on a log scale constant growth rate is represented by a straight line, and that the growth compounds, so that the underlying increase is exponential. Sooner or later, that has to end. Nothing in the real word can go to infinity. Here we see an exponential curve on a log scale. This demonstrates an increasing growth rate. Therefore, the underlying increase is greater than exponential. If exponential growth is unsustainable, what would you say about greater than exponential growth?

In fact, the whole trend might now be falling apart, as the last blue line has a much lower slope. Also, for the first time following a correction, profits have stayed below the trend line, and the gap is increasing.

To show the extent of national income capture by corporations, here is a graph of corporate profits as a percentage of GDP. I've divided the set into two segments: 1951 to 1979, and 1980 on, and had Excel place a linear trend line on each. This division is somewhat arbitrary, but almost every economic time series you can find has a break point within a few years of 1980. Division between '79 and '80 is the least favorable to my point that Profits/GDP had no trend in the post WW II Golden Age, but have trended sharply upward during the Great Stagnation period.

Profit/GDP growth was unusually poor from 1980 through 1986. Then from late 2001 through early 2006 it exhibited the greatest growth ever. But remember the denominator effect. Nominal GDP growth increased rapidly following the '80-'82 double recession; while GDP growth in this century has been generally slow. The financial melt-down of 2008 caused a dip that was sharp and brief, but the rebound has not gone to a new high. But even now, in the midst of anemic recovery, profit/GDP is hovering in the 9 to 10% range, far above historical norms.

CONCLUSION

The corporate profit growth picture looks unsustainable, and that is troubling. What it means for the future is anybody's guess. But, what we get from it is the first partial answer to the question, "Where has all the money gone?"

Gone to profits, everyone.

1/17 Update: Cross posted today at Angry Bear.

Labels:

Angry Bear,

economics,

great stagnation,

income and wealth

Monday, January 9, 2012

I Probably Wasn't Going To Do This Anyway . . .

I've pretty much outgrown my need for an adrenaline rush. Not so this cute Aussie.

I couldn't find any way to imbed the vid. Please follow this link into crocodile infested waters.

I couldn't find any way to imbed the vid. Please follow this link into crocodile infested waters.

Ron Paul Challenges Liberals - or Maybe Not

Matt Stoller, the former Senior Policy Advisor to Rep. Alan Grayson and a fellow at the Roosevelt Institute has a couple of very interesting articles posted at Naked Capitalism, Why Ron Paul Challenges Liberals, and the follow-up, Naked Capitalism, “A Home for All Sorts of Bircher Nonsense”

These are thought-provoking, in many ways insightful, and strike me as required reading, for a variety of reasons, including some valuable historical insights. However, one thought they provoke from me is that the main thesis is spectacularly wrong-headed. Stollar talks about what a great ally Paul's staff was, when working on certain issues. I should say, "when working against certain issues" or things, like war and the unfettered evil workings of the Federal Reserve. The correct vocabulary is worth emphasizing. Liberals and Libertarians may find common ground in what they are against, but it is quite unlikely that they will ever find anything substantial that they both are for.

Stollar goes on to point out what he calls "a big problem" with liberalism. This is the mixture of two elements, support for federal power and the anti-war sentiment that arose with Viet Nam and has continued though today. In the same paragraph, Stollar says, "Liberalism doesn’t really exist much within the Democratic Party so much anymore." This is an important thought, but he doesn't pursue it, and as he goes on seems to conflate Democrats with Liberals, as suits his convenience. In the final paragraph of the first post he refers to: "a completely hollow liberal intellectual apparatus arguing for increasing the power of corporations through the Federal government to enact their agenda." Seriously, WTF? I have absolutely no idea what the hell that is supposed to mean.

The second article is especially weak, and essentially devoid of any intellectual content. Stollar decides to "highlight a few of the reactions here without much of a rebuttal." Why would anyone do that? Does he believe the reactions are self-refuting? Is he too lazy to rebut, or does he simply not have a good rebuttal?

These are thought-provoking, in many ways insightful, and strike me as required reading, for a variety of reasons, including some valuable historical insights. However, one thought they provoke from me is that the main thesis is spectacularly wrong-headed. Stollar talks about what a great ally Paul's staff was, when working on certain issues. I should say, "when working against certain issues" or things, like war and the unfettered evil workings of the Federal Reserve. The correct vocabulary is worth emphasizing. Liberals and Libertarians may find common ground in what they are against, but it is quite unlikely that they will ever find anything substantial that they both are for.

Stollar goes on to point out what he calls "a big problem" with liberalism. This is the mixture of two elements, support for federal power and the anti-war sentiment that arose with Viet Nam and has continued though today. In the same paragraph, Stollar says, "Liberalism doesn’t really exist much within the Democratic Party so much anymore." This is an important thought, but he doesn't pursue it, and as he goes on seems to conflate Democrats with Liberals, as suits his convenience. In the final paragraph of the first post he refers to: "a completely hollow liberal intellectual apparatus arguing for increasing the power of corporations through the Federal government to enact their agenda." Seriously, WTF? I have absolutely no idea what the hell that is supposed to mean.

The second article is especially weak, and essentially devoid of any intellectual content. Stollar decides to "highlight a few of the reactions here without much of a rebuttal." Why would anyone do that? Does he believe the reactions are self-refuting? Is he too lazy to rebut, or does he simply not have a good rebuttal?

Wednesday, January 4, 2012

A B Post

My first post as an official member of the Angry Bear Team is up.

Speculation About Oil.

I'm not cross-posting here because the original draft was posted here back in May.

The new one is better.

Speculation About Oil.

I'm not cross-posting here because the original draft was posted here back in May.

The new one is better.

Labels:

Angry Bear,

commodities,

current events,

economics

Tuesday, January 3, 2012

New Writing Gig

I'm delighted to report that I have been invited to write for Angry Bear - an assignment which I eagerly accepted.

I have several posts in place in this obscure blog that I intend to polish up and republish at AB.

There will also be fresh material from time to time, which I will likely cross-post here, when it happens.

Wish me luck on this new adventure.

I have several posts in place in this obscure blog that I intend to polish up and republish at AB.

There will also be fresh material from time to time, which I will likely cross-post here, when it happens.

Wish me luck on this new adventure.

Monday, January 2, 2012

Andrew Samwick Does Not Exactly Tiptoe Around the Rentier Issue

Though he still doesn't quite confront it head on. Following up on the Delong post I cited here, Samwick says:

Recognizing the casino aspect is valuable in its own right. The important next step is to recognize that these rentier activities are not only socially useless but overtly harmful.

I feel like a voice crying out in the wilderness.

The larger context of Brad's post is to question whether the financial sector's increased share of GDP over the past six decades has contributed to economic growth. Given how much of the financial sector is no more socially useful than a casino, I don't see how that could be the case. Worse, the "house" and several of the "players" in this casino have used their growing resources to subvert our political institutions into believing that their institutions are "too big to fail."

Recognizing the casino aspect is valuable in its own right. The important next step is to recognize that these rentier activities are not only socially useless but overtly harmful.

I feel like a voice crying out in the wilderness.

Labels:

current events,

disappointment,

economics,

rentier

Sunday, January 1, 2012

Bellum Omnium Contra Omnes, or - The Life of a Coleoidean

Beginning from a mechanistic understanding of Teuthidan beings and the passions, one may postulate, Hobbes-like what life would be deep in the ocean, a condition which we might call "the state of saline-aquatic nature." In that state, each Decapodiform would have a right, or license, to everything in the ocean.

In such condition, there is no place for industry; because the fruit thereof is uncertain: and consequently no culture of the ocean; only navigation, but no use, other than the immediately culinary for the commodities that may be comported by sea; no commodious building, save coral reefs; no non-tentacular instruments of moving, and removing, such things as require much force; no knowledge of the face of the earth beyond the edges of the sea; no account of time in the dark depths; no arts; no letters; no society; and which is worst of all, continual fear, and danger of violent death; and the life of squids, solitary, poor, nasty, brutish, and short.

References.

Ref 1

Ref 2

In such condition, there is no place for industry; because the fruit thereof is uncertain: and consequently no culture of the ocean; only navigation, but no use, other than the immediately culinary for the commodities that may be comported by sea; no commodious building, save coral reefs; no non-tentacular instruments of moving, and removing, such things as require much force; no knowledge of the face of the earth beyond the edges of the sea; no account of time in the dark depths; no arts; no letters; no society; and which is worst of all, continual fear, and danger of violent death; and the life of squids, solitary, poor, nasty, brutish, and short.

References.

Ref 1

Ref 2

Labels:

destiny,

gratuitous obscurity,

humor,

other living things,

squid

New Year's Sunday Music Blogging

I can think of no better piece to usher out the travisty that was 2011 and invite in the potential disaster that 2012 may well turn out to be than Sequenza V, by Luciano Berio.

Here, it is performed by the incomparable Christian Lindberg.

I dedicate this post to the insane clown posse posing as the slate of Rethug presidential candidates.

Here, it is performed by the incomparable Christian Lindberg.

I dedicate this post to the insane clown posse posing as the slate of Rethug presidential candidates.

Subscribe to:

Comments (Atom)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/tny_au_xx_usoz_4.gif)