Monday, September 20, 2021

Red Arrow Down, Down, Down

DJI30 Index at the close --- 33,970.47 -614.41 (-1.78%)

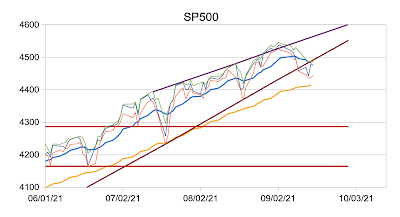

SP500 Index --- 4,357.73 -75.26 (-1.70%)

NASDAQ Index --- 14,713.90 -330.06 (-2.19%)

Russell 2000 Index --- 2,182.20 -54.67 (-2.44%)

The DJI opened at 34469, gapping down by 160 points. It immediately fell to 33988, off 598. It then went sideways, between that level and 34215 until about noon, when it broke lower, hitting bottom, 33613, off 972, about 3:15. From there it rose over 300 points into the close. At the lo, it was only 87 points above the support level at 33526.

This is about as clearly a down day as you can ever imagine, with the hi lower by 320 points, and the lo lower by a stunning 907. The span was 847 points, the largest this year.

On Friday I said, ”But if subwave iii of 3 down is starting, the magnitude of the drop next week could be breath-taking.” And now, this certainly does look like that kind of 3rd wave action. I chose the DJI for that comment because the wave form was clearest in that Index. The recovery in the last hour might be all or part of subwave iv. When that is completed, we can expect a further drop in the next couple days.

All the indexes had similar contours. The SP500 also hit bottom around 3:15, just like the DJI. It was clearly down by 69 and 122 points.

The NASDAQ also hit its lo around 3:15, and finished with a larger percentage loss. It was clearly down by 39 and 48 points.

The Russell 2000 also hit its lo around 3:15. I had a clearly down day by 8 and 65 points.

This entire year has been spent in elevated territory never before visited by any of the indexes. Many pundits and analysts have been giving fundamental and technical reasons why the markets are due for some sort of a pull back. The Elliott wave analysis I'm aware of has been calling for a rather dramatic drop, followed by another surge to new highs over the next year or two. After that, there will either be a crash or doldrum lasting for several years. Whichever way that plays out, returns from equities will be then either flat or down during that time.

If you believe in reversion to mean, you'll realize that this is inevitable. After the crash of 1929, the DJI didn't recover to it's pre-crash high until 1954 – 25 long years of depression and war.

NYSE internals were extremely weak on very high volume

Daily % Changes -

DJI30 -1.78%

SP500 -1.79%

NASDAQ -2.19%

Russell -2.44%

DJI Closings -

9/17/19 - 26926

9/17/20 - 27657

8/20/21 - 35120

9/20/21 - 33970

NYSE Internals -

A/D = 532/2798 = 0.19

A/D Vol = 0.11

New Hi/Lo = 15/88 = 0.17

Tuesday, September 21, 2021

Yellow Arrow Sideways

DJI30 Index at the close --- 33,919.84 -50.63 (-0.15%)

SP500 --- 4,354.19 -3.54 (-0.08%)

NASDAQ --- 14,746.40 +32.49 (+0.22%)

Russell200 --- 2186.18 +3.98 (+0.18%)

The DJI opened at 34025.61, up 55 points, and within 20 minutes reached the day's hi of 34314, up 343. It hit near the low, 33914, off 56 points at 11:00, 2:30, and at the close. This is an inside day with the hi lower by 146 points, and the lo higher by 301. The span was 400 points. At yesterday's lo, it was off more than 5%, and finished above that level today.

The SP500 had an almost identical contour, touching near it's lo of 4348 at 11:00, 2:30 and the close. This is an inside day by 8 points at the top and 42 at the bottom. At yesterday's lo, it was off more than 5%, and finished above that level today.

The NASDAQ had a roughly similar contour, but only touched negative territory at its 11:00 low. It had a clearly up day by 5 points at the top and 166 at the bottom. At yesterday's lo, it was off more than 5%, and finished above that level today. It was today's strongest performer.

The Russell 2000 was most similar to the NASDAQ , touching negative territory only once near 11:00. But it had an inside day by 31 points at the top and 17 at the bottom. It has been bouncing around its 5% off level for weeks. It dipped within 31 points of being 10% off at yesterday's lo.

Every index hit its daily high early in the session, and after that, motion was sideways to down for the rest of the session. They are all running below their 55 day EMAs.

I suspect the rise at the end yesterday, and the continuing sideways motion today, are parts of subwave iv of wave 3 down. If this is correct, subwave v down is still ahead of us, and we can expect another leg lower before the end of the week. This also suggests a future counter-current wave 4 up at the next higher level of trend, followed by wave 5 down. It's tough to determine exactly which level of trend is being observed in real time; so there is lot of uncertainty in the short term. Either way, though, it suggests that the indexes have not reached their local bottoms.

DJI Closings -

9/20/19 - 26935

9/21/20 - 27148

8/20/21 - 35120

9/21/21 - 33920

NYSE Internals -

A/D = 1782/1473 = 1.21

A/D Vol = 0.98

New Hi/Lo = 38/46 = 0.83

Wednesday, September 22, 2021

Green Arrow Up

DJI30 Index at the close --- 34,258.32 +338.48 (+1.00%)

SP500 --- 4,395.64 +41.45 (+0.95%)

NASDAQ --- 14,896.85 +150.45 (+1.02%)

Russell 2000 --- 2,218.56 +32.38 (+1.48%)

The DJI opened at 34007, up 87 points and continued climbing, reaching a hi of 34419, up 500 before noon. It then ran mostly sideways, hitting the day's hi, 34440, at 2:15. From there it dropped to 34215 before 3:00. It rose back to 34410 before 3:30, then dropped 152 points into the close. This was a clearly up day by 127 points at the top and 93 at the bottom. The span was 434.

The SP500 had a nearly identical contour. It had a clearly up day by 22 and 19 points.

As did the NASDAQ, with a smaller fall off at the end. It had a clearly up day by 103 and 71 points.

The Russell 2000 was most similar to the NASDAQ, and had the day's largest gain. It was clearly up by 32 and 15 points.

An up day is a lot more fun than a down day. But util the indexes climb back above their local highs from earlier this month the trend is, at best, sideways. The indexes achieved their highs late in the day, but could not hold them. The droops into the close are not comforting.

DJI Closings -

9/20/19 - 26935

9/22/20 - 27288

8/20/21 - 35120

9/22/21 - 34258

NYSE Internals -

A/D = 2679/673 = 3.98

A/D Vol = 5.57

New Hi/Lo = 68/25 = 2.72

Thursday, September 23, 2021

Green Arrow Up

DJI30 Index at the close --- 34,764.82 +506.50 (+1.48%)

SP500 --- 4,448.98 +53.34 (+1.21%)

NASDAQ --- 15,052.24 +155.40 (+1.04%)

Russell 2000 --- 2,259.04 +40.48 (+1.82%)

The DJIl opened at 34296, up 38 points, and at 10:00 reached 34740, up 482. After that, it climbed more slowly, reaching the hi of 34880, up 621, at 2:00. From there it was a 115 point slide into the close. This is a clearly up day by 439 points at the top and 289 at the bottom. The span was 583.

The SP500 had a nearly identical contour, but a smaller gain. It had a clearly up day by 49 and 39 points,

The NASDAQ was roughly similar, with a still smaller gain. It was clearly up by 135 and 167 points.

The Russell 2000 had similar contour, but with a steeper rise into its 2:00 high, and wound up with the day's largest gain.

The gains yesterday and today have brought the indexes about back to where there were from 9/14 to 9/16. They are still below their recent highs. Unless those highs are exceeded, the man thrust might still be down.

A break below the recent lows would confirm that the decline is continuing.

DJI Closings -

9/23/19 - 26950

9/23/20 - 26763

8/23/21 - 35336

9/23/21 - 34765

NYSE Internals -

A/D = 2139/1133 = 1.89

A/D Vol = 4.21

New Hi/Lo = 102/33 = 3.09

Friday, September 24, 2021

Yellow Arrow Sideways

DJI30 Index at the close --- 34,798.00 +33.18 (+0.10%)

SP500 --- 4,455.48 +6.50 (+0.15%)

NASDAQ --- 15,047.70 -4.54 (-0.03%)

Russell 2000 --- 2,248.07 -10.97 (-0.49%)

The DJI opened at 34762, off 3 points, immediately fell to 34648, off 117, and rebounded near 34850, up about 85, at 10:00. It then meandered around neutral, near the middle of that range, until after 2:00 when it started rising. It exceeded that range briefly in the closing moments, reaching 34857, up 92, before falling 59 points into the close on a small volume surge.

This is an inside day, by 23 points at the top and 352 at the bottom. The span was a modest 209.

The SP500 had a similar contour. It also had an inside day by 2 points at the top and 24 at the bottom.

The NASDAQ started negative and climbed most of the day, briefly going green after 3:30. It then slid 33 points into the close, for a very small loss. It had an inside day by 18 points at the top and 14 points at the bottom.

Except for a brief bump above neutral around noon, the Russell 2000 spent the entire day in the red, finishing with a loss of almost a half percent. It also had an inside day, by 18 points at he top and 14 at the bottom.

An inside day gets a yellow arrow by definition. Small changes validate this conclusion. Over the last several day, with a lot of gyrations, markets have gone nowhere.

Today's sideways motion is counter-current. But at what level of trend? Is it a pause in the increases of the last two days, or part of consolidation in the down-slope from the local highs earlier this month? It's very difficult to tell, so we'll need to see which way it goes next week. I know this is not helpful, but it's where we are.

Weekly % Changes -

DJI30 +0.62%

SP500 +0.51%

NASDAQ + 0.02%

Russell +0.50%

DJI Closings -

9/24/19 - 26808

9/24/20 - 26815

8/24/21 - 35366

9/24/21 - 34798

NYSE Internals -

A/D = 1349/1927 = 0.70

A/D Vol = 0.82

New Hi/Lo = 78/44 = 1.77

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/tny_au_xx_usoz_4.gif)